QR Code Swindlers: Customers Play Tricks, JB Restaurant Pay The Price

One customer was expected to pay RM13 but only settled RM3, while another left with a bill of RM15.50 but only paid a mere 50 cents.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

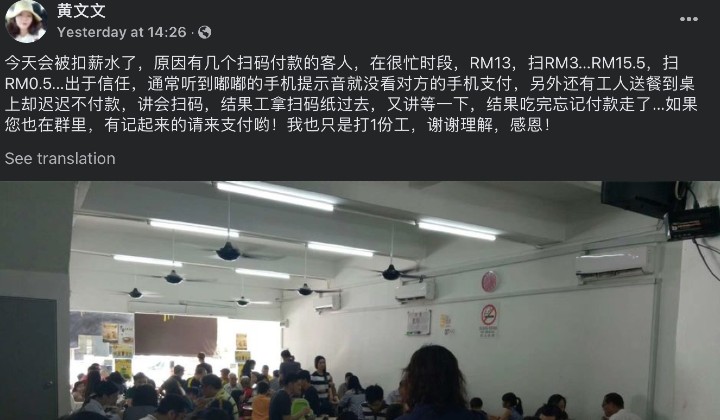

A restaurant worker in Johor Bahru faces the prospect of having her salary deducted due to unpaid customer payments.

The worker, who shared the experience on social media, highlighted several instances where customers made payments through scanning QR codes but failed to pay the actual amount.

She would hear a beep on her phone after customers paid by scanning the QR code.

She trusted the process and didn’t verify the payment details on the customer’s phone screen.

However, to her surprise, she later discovered that the amount received was less than the bill.

Urgent Appeal for Payment Responsibility

Citing examples, she said one customer was supposed to pay RM13 but only settled RM3, while another had a bill of RM15.50 but only paid 50 cents.

Additionally, there were cases where customers delayed payment after food had been served, only to forget to settle the bills before leaving.

She later added that her employer did not deduct her wages concerning this incident.

However, she is worried as similar occurrences happen thrice a day.

In hopes of resolving the issue, she appealed to customers to settle their outstanding bills.

She added that these incidents mainly occurred during busy periods in the afternoon when the restaurant was packed with customers.

Rise of QR Code Payment Scams: Threatening Malaysia’s Payment Landscape

In Malaysia, QR code payment scams have unfortunately become increasingly common.

Fraudsters use the convenience and popularity of QR code payments to deceive unsuspecting individuals.

These scams often involve manipulating or replacing legitimate QR codes with fraud, leading to payments being redirected to unauthorized accounts.

The worker’s experience is a cautionary tale, highlighting the importance of vigilance when making QR code payments.

Customers should verify the authenticity of the QR code and ensure that the payment is being made to the intended recipient.

It is advisable to double-check the payment amount and recipient details before confirming the transaction.

Empowering Merchants: Innovative Solutions to Combat QR Code Tricks

Businesses, on their part, should prioritize implementing robust payment systems that incorporate security measures to protect customers and workers.

This includes regularly monitoring and verifying QR codes and educating customers about safe payment practices.

READ MORE: [Watch] Burger Vendor Shares His Ordeal After Mother-Son Duo Scam Him Of RM98 Through QR Code Trick

Some netizens have proposed a solution for merchants to address this issue – acquiring Touch ‘n Go e-wallet speakers.

This innovative approach involves announcing the payment amount whenever a customer settles their bill, serving as a preventive measure to avoid similar situations.

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.