Man Recovers 95% Of Money Stolen From His Savings Account

The bank recovered the money as the transaction was still in the floating stage.

Subscribe to our Telegram channel for the latest stories and updates.

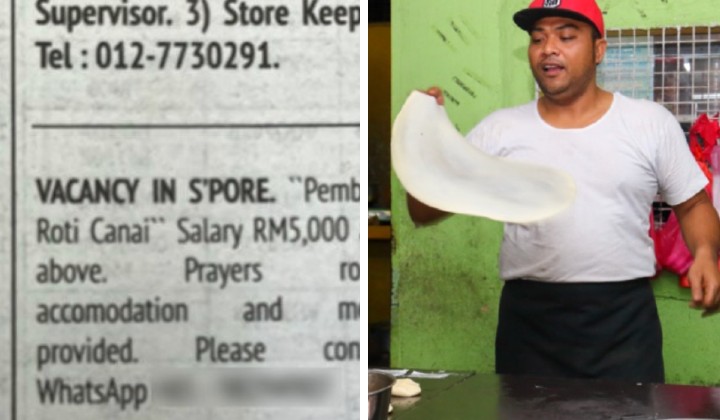

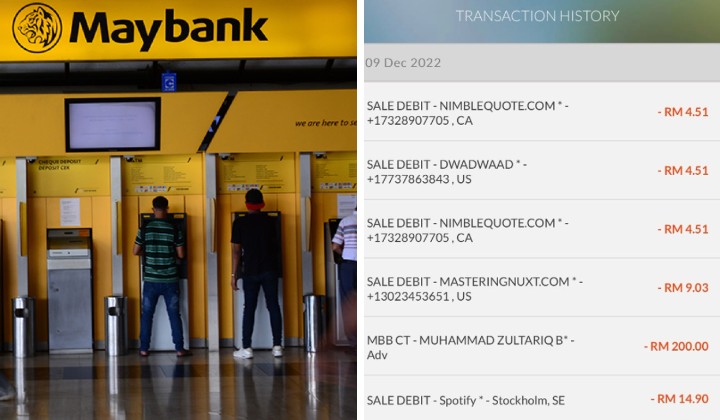

A man claimed to have lost almost RM5,000 from his Maybank account last Friday (December 9) due to fraudulent transactions.

Fortunately, according to him, the bank suspended the transactions after discovering it, allowing him to get back 95% of the money.

Tarique Zain tweeted that the scammer transferred his money several times.

The largest transaction was RM3,351.84, and there were even multiple small transfer records of RM4.51, leaving only RM1.47 in his bank account.

New update: alhamdulillah gaiss.

— Tarique Zain (@tariquenano) December 13, 2022

Pihak @MyMaybank berjaya kembalikan almost 95% amount yang kena sedut haritu gais.

Ada lagi 3 transaksi sedutan yang belum direfund lagi.

Untuk keselamatan aku dah transfer dulu ke acc bank yang lain. https://t.co/M92RaIilHp pic.twitter.com/1nM0GFTaxP

Tarique said he rushed to the Maybank branch to deal with the matter as soon as possible.

Fortunately, the bank said that these transactions were still floating and had not been fully transferred to the other party’s account; hence they could suspend the transaction in time.

In banking, float refers to the money that is double counted due to delays in deducting funds from the payer and depositing the payee.

The man also tweeted that three fraudulent withdrawals and transfers are pending recovery.

He also tagged the Prime Minister, urging Datuk Seri Anwar Ibrahim to do something to deal with the growing number of cyber scam cases.

READ MORE: Shah Alam Woman Shops For IPTV App, Loses RM10,000 After Installing APK Via WhatsApp

At the same time, netizens speculated how scammers could have obtained the victim’s banking details, including data leaks.

mengikut history transaksi dibuat tu rata2 luar negara..cuma 1 saja dlm negara, mungkin org tu testing dulu yg mula2 tu. Barangkali no kad tu salah drpd list kebocoran yg di curi sblm ini & di leak/share dlm forum database kecurian data

— ₳łⱤ₮Ɇ₥₱Ø ™ ₣Ⱡł₱ 🎭 (@Loverboxs) December 13, 2022

Will The Bank Refund Scammed Money?

Most banks should reimburse you if you’ve transferred money to someone because of a scam.

They might be able to trace where your money has gone, and if they’re successful, they may be able to get your money back.

READ MORE: [Watch] Malaysian Holidaygoer Loses RM28,500, Allegedly Scammed By Online Travel Agency

If the merchant agrees to cancel the purchase, the merchant will inform his banking institution (i.e. the merchant acquirer) to reverse the transaction.

Upon confirmation from the merchant acquirer, the cardholder’s banking institution will reverse the charge from the cardholder’s account.

To file a complaint with Bank Negara Malaysia (BNM), you can call their BNMTELELELINK at 1-300-88-5465 (1-300-88-LINK).

The public can also call National Scam Response Centre (NSRC) at 997 to report online financial scams.

If you suspect you’ve been scammed, immediately call:

— Maybank (@MyMaybank) November 27, 2022

🆘 03-58914744 – Maybank’s 24/7 Fraud Hotline

🆘 997 – National Scam Response Centre (8am-8pm daily)

Learn more at https://t.co/ayacsLAzjb #JanganKenaScam

(2/2)

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.