How To Apply For EPF’s RM10,000 Special Withdrawal And Check Your Eligibility

Application starts 1 April and ends at the end of next month, with payment period starting from 20 April.

Subscribe to our Telegram channel for the latest stories and updates.

Malaysians are rejoicing as the government has agreed to approve another withdrawal of Employees Provident Fund (EPF) savings of RM10,000.

The government had previously allowed the withdrawal of EPF contributions through various schemes, namely i-Lestari, i-Sinar and i-Citra amounting to RM101 billion.

The schemes involved 7.34 million contributors since the Covid-19 pandemic hit the country two years ago.

Applications for the special withdrawal will be open to members under the age of 55 starting 1 April and ending at the end of next month.

The EPF said in a statement that the payment period will start on 20 April, 2022.

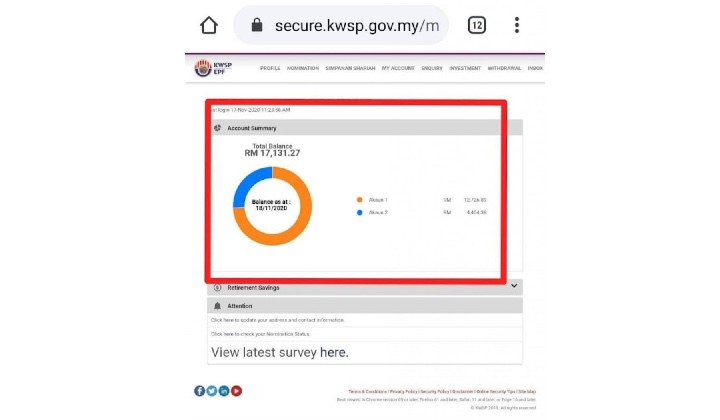

How To Check the Latest EPF Account Balance

- To check your latest EPF balance, please refer to the following steps:

- Login to EPF i-Account: https://secure.kwsp.gov.my/member/member/login

- Go to the Account menu

- Click on ‘Current Year / Previous Year Statement’

- Click View Details

- The information will be displayed as below.

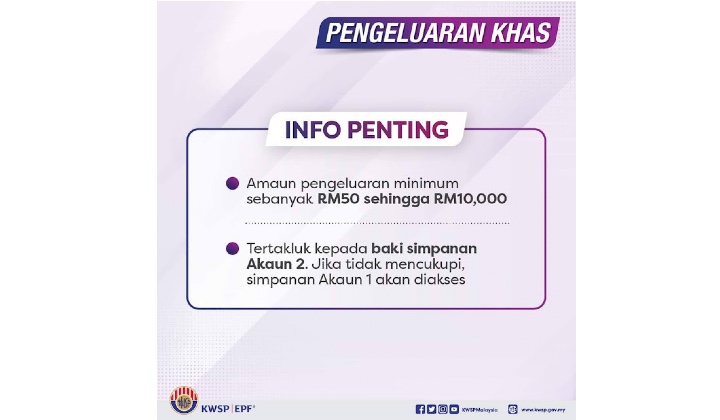

Total Withdrawals Allowed

EPF members are allowed to withdraw a maximum amount of RM10,000 and a minimum of RM50.

They have to withdraw from the savings balance in their Account 2 before accessing the savings in Account 1.

EPF mmembers can mafe the withdrawal at https://pengeluarankhas.kwsp.gov.my/ through the i-Account starting 1 April.

But what is the difference between Account 1 and 2 in EPF?

Effective 1 January 2007, a member’s EPF savings consists of two accounts that vary by their share of savings and withdrawal flexibilities.

Account 1 stores 70% of the members’ monthly contribution, while the second Account 2 stores 30%.

.@KWSPMalaysia umum cara keluarkan rm10,000 pic.twitter.com/iSwgAcX2h3

— Ibrahim Sani (@ibrahimsaninet) March 29, 2022

Difficult Decisions In The Interest Of The People

The government allowed the special withdrawal to ease the burden of Malaysian families who are still affected by the Covid-19 pandemic.

Prime Minister Datuk Seri Ismail Sabri Yaakob said the special withdrawal was a middle ground in balancing between present urgent needs and future savings.

A comprehensive study and research in posy-Covid recovery phase found that many Malaysian families are still affected economically, having lost their income and are rebuilding their lives.

Ismail Sabri said the government had listened and studied requests from all parties to withdraw EPF contributions.

READ MORE: EPF Withdrawal Without Good Reason Must Pay 2.5% In Zakat

How Malaysians Spend Their EPF Money

Malaysians had been withdrawing the EPF money for investment purposes such as buying gold or stocks, according to a study by the UCSI Research Center.

The survey involved 809 respondents from across the country who have or were planning to apply for i-Sinar.

According to the study, the T20 group made up 47.7 per cent of the contributors who withdrew i-Sinar money for investment purposes, followed by M40 at 35.3 per cent and B40 at 31.1 per cent.

Overall, they made up 34.9 per cent of the total respondents who stated that the withdrawal of i-Sinar money was for investment purposes.

A total of 55.5 per cent of EPF contributors used i-Sinar money to pay monthly insurance, followed by the purchase of kitchen items and food (48.6 per cent).

Other purposes include home renovations (32 percent), gadget purchases (24.1 percent) and saving in bank accounts (18.4 percent).

The UCSI Research Center also found that repaying loans was the main purpose for respondents to make i-Sinar withdrawals for the B40 and M40 groups, as well as those aged between 26 to 55 years.

Kawan2,

— 🏴 ZackXVince 🏴 (@vince_zack) October 31, 2020

Klu x de keperluan JANGAN kuarkan duit epf ko

T

Duit epf bukan utk beli iphone baru

Bukan utk beli motor baru

Bukan utk beli tv, game console, airpods or iwatch

Skrg korang x nampak penting nya ada epf..kau komplen potong2 byk

Besok kau dh tua baru kau sesal

SO DONT! https://t.co/3gSJOMaMik

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.