Average GLC CEO Pay Is 300x Employee Minimum Wage, Creates Incompetency, Says Study

They said the gap is way more than in the UK.

Subscribe to our Telegram channel for the latest stories and updates.

The average pay of Executive Directors government-linked companies (GLCs) is more than 300 times the minimum wage of employees, according to a blog post published by the London School of Economics (LSE).

It’s taken from the book, HOW MUCH IS HIDDEN? Pay for Elites in Government-Linked Entities written by Co-Director of the International Centre for Management and Governance Research (ICMGR) Dr Marizah Minhat and Edinburgh Napier University Associate Professor Dr Nazam Dzolkarnaini.

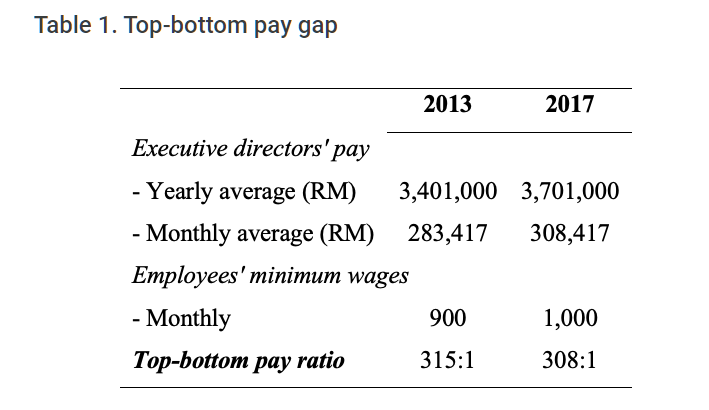

For their research, they studied the disclosures and levels of Directors’ remuneration of Malaysia’s GLCs during the 2013-2017 period.

Based on a sample of limited disclosure, the researchers found that the average individual pay disclosed for 49 GLE Executive Directors (including CEOs) had increased from RM3.401 million in 2013 to RM3.701 million in 2017.

They also noted that Executives took home an average of RM308,417 in 2013 compared to RM283,417 in 2017.

Although this figure may still be underestimated (i.e., due to inadequate or non-disclosure items), it is certainly not a ‘humble’ amount to begin with for these elites.

Co-Director of the International Centre for Management and Governance Research (ICMGR) Dr Marizah Minhat and Edinburgh Napier University Associate Professor Dr Nazam Dzolkarnaini

Not all GLCs are created equal

The study also found that that not all GLEs have achieved satisfactory levels of disclosure for their directors’ pay because not all of them are subject to disclosure requirements.

They said that although the top 10 companies listed in the FTSE Bursa Malaysia KLCI (FBMKLCI) are government-linked entities, many GLCs are not publicly listed companies, which means that they are not tied to and regulated by stringent pay disclosure rules.

For example, the remuneration of individuals that served on the boards of 1MDB, SRC and two other strategically important GLCs (Khazanah Nasional Berhad and Permodalan Nasional Berhad) were hidden from public view. In other cases where disclosure was required, salaries and bonuses of individual executive directors were disclosed, but values of long-term incentive plan (e.g., stock options), pension benefits, and other perks were largely opaque in selected cases.

Co-Director of the International Centre for Management and Governance Research (ICMGR) Dr Marizah Minhat and Edinburgh Napier University Associate Professor Dr Nazam Dzolkarnaini

Stark contrast to the UK

The researched compared the collected data to CEOs of FTSE 100 companies and found that the pay gap was not as wide, adding that it was still subject to scrutiny by the public.

FTSE 100 is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation.

FTSE 100 companies are distinguishable from Malaysia’s GLEs as they operate in a more competitive market-based system where stakeholders are relatively sophisticated and facilitated by a rigorous disclosure regulation on directors’ remuneration. As a result, the pay gap between executive directors and employees in the UK are gradually being ‘humbled’ by market forces as well as scrutiny from civil society.

Co-Director of the International Centre for Management and Governance Research (ICMGR) Dr Marizah Minhat and Edinburgh Napier University Associate Professor Dr Nazam Dzolkarnaini

High wages for poor performers

The researchers said that although a complete picture of directors’ pay in GLEs remains hidden, their findings reveal a wide pay gap between the top and bottom strata of society in Malaysia.

In any case, rewarding a mediocre performance with an extravagant pay is a source of inefficiency, which must be curtailed in tackling the gap between rich and poor.

Co-Director of the International Centre for Management and Governance Research (ICMGR) Dr Marizah Minhat and Edinburgh Napier University Associate Professor Dr Nazam Dzolkarnaini

They also argued that the tendency for inefficient pay is greater if government-linked corporations are managed by self-interested agents, while monitoring by the ultimate stakeholder (the public) is lacking due to factors such as coordination amongst diverse stakeholder groups, inadequate disclosure and the sheer complexity of pay structures.

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.

Unkempt in both stories and appearance, Hakim loves tech but tech left him on read, previously he used to write about tall buildings and unoccupied spaces that he can't afford, and legend has it that he still can't afford it to this day