EPF Dividend Delight Causes App Crash: Members Rush For Updates

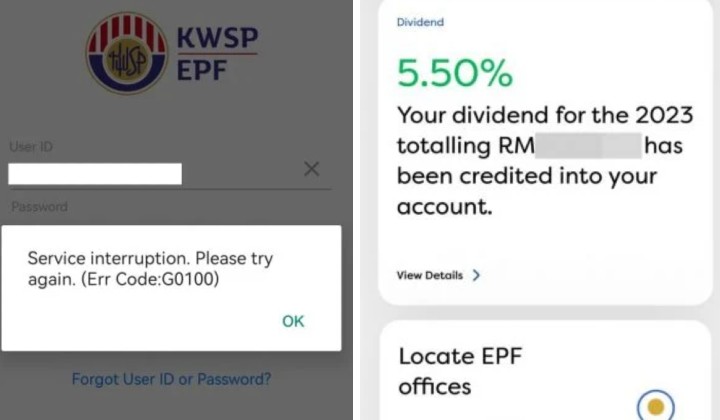

The announcement of the 2023 dividend payments by the EPF led to an unprecedented digital rush, temporarily paralysing the EPF mobile application as members flocked online to check their updated balances.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

In a turn of events that underscores the digital era’s challenges and opportunities, the Employees Provident Fund (EPF) mobile application experienced temporary paralysis following the announcement of its 2023 dividend rates.

The surge in traffic came as members eagerly attempted to access their accounts to view the newly credited dividends, causing system crashes and service interruptions.

The provident fund announced a dividend rate of 5.5% for traditional savings accounts and 5.4% for Islamic savings accounts for 2023, both marking an increase from the previous year’s rates.

The EPF mobile app displayed messages indicating that the system was undergoing maintenance due to the update and assured users that normal service would be restored shortly.

Saw a glimpse of my EPF dividend on the I-Akaun app, now error balik lol.

— Intern Zen Master (@InternZenMaster) March 3, 2024

Crash and Learn

Despite initial frustrations, persistent members who attempted multiple logins eventually succeeded in accessing their account information.

This incident highlights the significant interest in EPF dividends among Malaysians and points to the broader implications of digital dependency for financial institutions.

Lama tak check duit kwsp, oooo begitu begini

— ain (@Shhhain) March 3, 2024

The temporary disruption caused by the influx of users underscores the need for a robust digital infrastructure to handle peak traffic, especially during critical financial announcements.

As Malaysia continues to embrace digital finance, this episode serves as a reminder of the growing pains associated with transitioning to online platforms.

It also emphasizes the importance of continuous improvement in digital services to meet the increasing demands of users seeking instant access to their financial information.

Despite the temporary setback, the successful crediting of dividends has been a cause for celebration among EPF members.

It reflects the fund’s commitment to providing competitive returns to its members, contributing to their long-term financial well-being.

As digital solutions evolve, so will the efficiency and reliability of accessing vital financial services, ensuring that incidents like today’s become a thing of the past.

KWSP website terus hang eh 😂😂

— tyra | I Stand with 🇵🇸 (@TYRADNE) March 3, 2024

READ MORE: EPF Announces 5.5% Dividend Rate For 2023, 5.4% For Syariah Savings

Share your thoughts on TRP’s Facebook, Twitter, and Instagram.