Analysts Describe Housing Prices In Malaysia As ‘Highly Unaffordable’

The selling prices of homes have become a significant barrier for individuals seeking housing financing, evident in the rejection of 86.1% of loan applications.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

The choice between buying and renting a residence is a topic often debated among the public.

Some prefer renting over buying property due to the excessively high property prices, which can sometimes impose a heavy financial burden on consumers.

Analysts Label House Prices as Unaffordable

According to analysts at Maybank Investment Bank Bhd (Maybank IB), Desmond Ch’ng, residential property prices in every state in Malaysia are described as ‘highly unaffordable.’

This is because the majority of homes for sale are beyond the financial reach of most individuals.

It also serves as the primary obstacle for households in securing housing financing, with 86.1% of loan applications being declined.

“This is primarily due to the high house prices, which exceed the financial capacity of households, even with the presence of loan guarantee schemes,” he stated.

Median House Prices and Unsold Unit Numbers Decrease

However, Ch’ng pointed out that the median house prices in comparison to median income levels showed a decrease by the end of 2022 compared to 2020.

“Affordability remains a significant concern. House prices increased by 4.8% year on year in the first quarter of 2023, compared to 3.9% in the previous quarter. This is compared to a long-term average of 5.3% from 2015 to 2019,” he added.

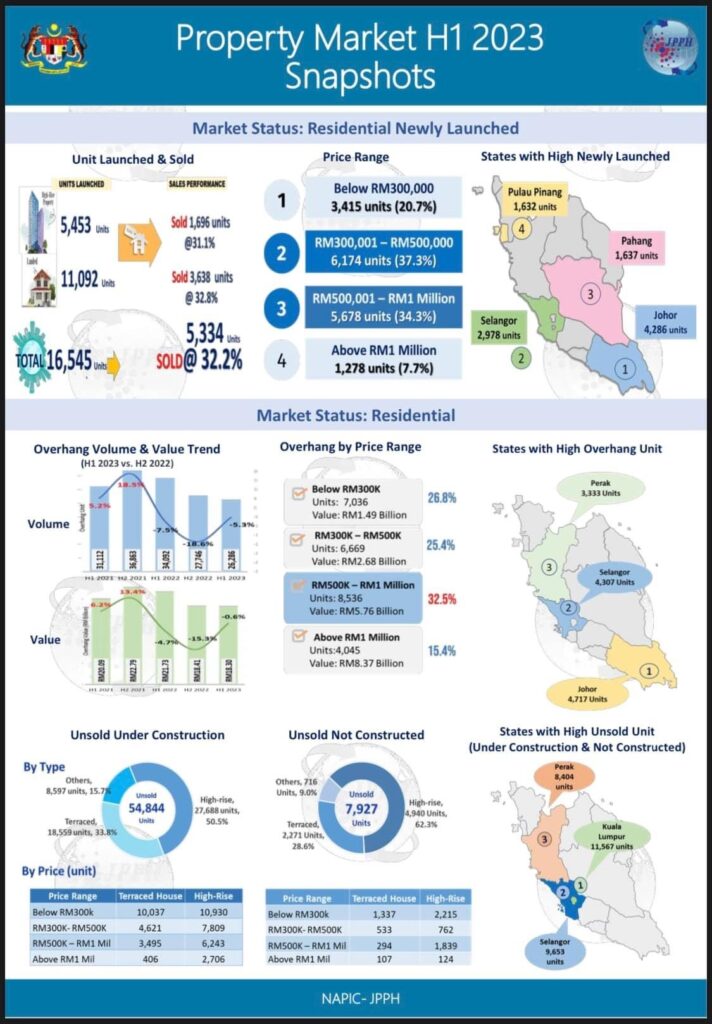

An oversupply of housing also witnessed a reduction, with a decrease in the number of unsold housing units to 141,855 in the second quarter of this year compared to the highest recorded level of 183,918 units in the fourth quarter of 2021.

Meanwhile, the average for the period from 2015 to 2019 was 130,210 units.

“Homes priced at RM500,000 or less accounted for nearly 80% of the total property transactions in the first half of 2023.

However, the supply of new residential properties priced at RM500,000 and below decreased by 58% from the total new launches, compared to 71.1% last year,” he explained.

Previously, the First Half of 2023 Property Market Report published by the National Property Information Center (NAPIC) found that houses already built in the price range of RM500,000 to RM1 million recorded the highest percentage of the most unsold units at 32.5%.

Meanwhile, residences priced below RM300,000 ranked second with a percentage of 26.8%, 25.4% for properties priced between RM300,000 and RM500,000, and 15.4% for properties priced above RM1 million.

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.