Taxing Times Ahead: Malaysian Government Announces Service Tax Hike and E-Invoicing Mandate

The government’s move to increase the service tax rate and expand the scope of taxable services is expected to generate more revenue for the government and improve the country’s financial situation.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

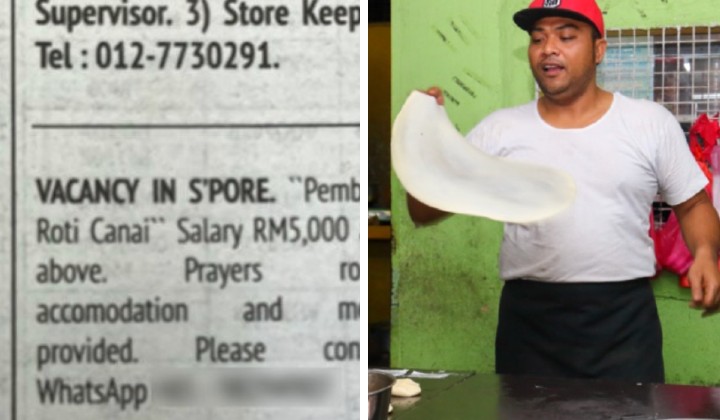

The government has announced plans to increase the service tax rate from 6% to 8%, excluding food, beverages, and telecommunications services.

Prime Minister Datuk Seri Anwar Ibrahim revealed this while presenting the Budget 2024 in Parliament today (13 October).

Additionally, the government will expand taxable services to include logistics, brokerage, underwriting, and karaoke services.

The High-Value Goods Tax will also be raised from 5% to 10% on certain high-value items like jewellery and watches to generate more revenue.

Furthermore, e-invoicing will become mandatory for taxpayers with income or annual sales exceeding RM100 million from 1 August 2024.

Taxpayers in other income categories will be implemented in phases, with a comprehensive implementation targeted by 1 July 2025.

This move aims to increase the government’s revenue and improve the country’s financial situation.

#Malaysia govt plans to raise service tax from 6% to 8% but it does not include services such as food, beverages and telecommunications, says PM Anwar Ibrahim during tabling of #Budget2024 in Parliament todayhttps://t.co/4g5yAuTGTP

— Amy Chew (@1AmyChew) October 13, 2023

Meanwhile, the implementation of targeted subsidies will be carried out gradually, commencing next year.

The savings resulting from the rationalization of subsidies will be redirected towards increasing cash aid from RM 8 billion to RM 10 billion, as stated by the Prime Minister.

Budget 2024: Part of the subsidy savings will be channelled directly to increase the allocation of cash assistance through Rahmah cash contributions from RM8 billion to RM10 billion – PM Anwar #BernamaBiz #Budget2024

— Bernama Business (@BernamaBiz) October 13, 2023

Exploring Revenue Generation Strategies: Government’s Response to Financial Challenges Amidst the Pandemic

The government has faced significant financial challenges due to the COVID-19 pandemic and the global economic slowdown.

The pandemic has caused a significant decline in revenue from various sectors, including tourism and manufacturing.

Therefore, the government seeks to generate more revenue through various means, including increasing taxes on certain goods and services.

The decision to exclude food, beverages, and telecommunications services from the increased service tax rate aims to reduce the tax hike’s impact on the general public.

These services are essential and crucial for daily life, so they have been exempted from the increased service tax rate.

We are feeling the cost of living of crunch because for 50% of us preCovid 2019 till 2022, increment is ZERO but food prices have increased by 15% pic.twitter.com/uRjFVPsChy

— khalid karim ARISE MALAYSIA (@khalidkarim) October 11, 2023

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.