Couple Asks Public For Money To Pay Credit Card Debts

After the post was published, it was bombarded overwhelmingly

by netizens.

Subscribe to our Telegram channel for the latest stories and updates.

A couple owed more than RM2,000 in credit card debts and publicly raised funds from netizens on social media to pay off the debts.

As a result, they were ridiculed and scolded by netizens who advised the two to find a job to make money and pay off the debt.

The couple claimed that due to business problems, they had been using credit cards for living expenses, so they owed more than RM2,000 in credit card debt.

They added that they are sincerely looking for financial help as they have credit card debt due to business issues and have been living on credit cards for months.

The couple will be very grateful to anyone willing to help them, and they can private message for more details.

Public Onslaught

However, after the post was published, netizens bombarded it overwhelmingly.

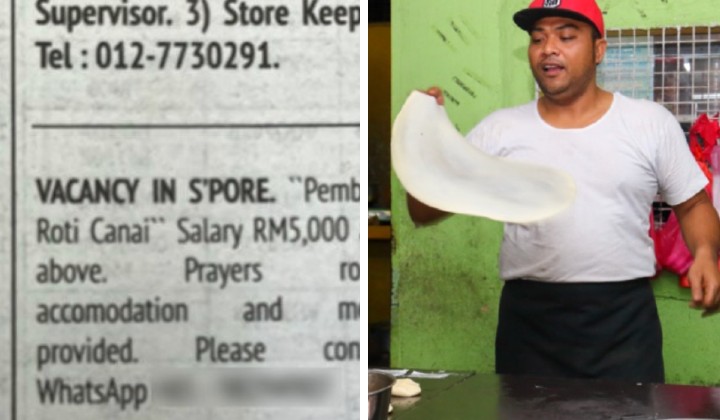

Most of them told the couple to find a job to make money themselves and not beg for money on social media.

In addition, some netizens also creatively replied to the tweet, directly posting a job application form.

I’m crying 🤣🤣🤣🤣🤣

— Farizan Jaffar (@FarizanJaffar) March 1, 2023

Many netizens also criticized the two, saying they should be ashamed to ask others to help them repay their debts.

Some even maliciously persuaded the woman to break up with her boyfriend and find a sugar daddy to help repay their credit card debts.

Others sarcastically said they, too, needed help to pay off loans.

Seriouslah?

— Sarahliya (@Sarahliyaaaaaa) March 1, 2023

Swipe Responsibly

Credit cards can be a convenient way to make purchases and allow you to earn cash or other rewards for the things you buy every day.

But they can also lead to overspending and debt accumulation if not used responsibly.

Credit card companies often charge high-interest rates on unpaid balances, which can add up quickly if the cardholder carries a balance from month to month.

Bagus atau tak kad kredit ni?

— Akmal (@_mhmdaml) March 4, 2023

Jawapan dia bagus kalau pandai jaga bayaran balik hutang.

Bank akan tengok cara korang bayar hutang kad kredit untuk tentukan korang ni high risk/low risk.

Bila korang bayar hutang dengan baik, korang akan dapat beberapa advantage — https://t.co/N1MXNRfUNV

Therefore, it’s essential to manage credit card usage and pay off the balances promptly to avoid falling into a debt trap.

In conclusion, while credit card debt may be a contributing factor to the overall household debt in Malaysia, it’s not the only cause.

A wide range of factors, such as housing loans, car loans, personal loans, and education loans, can also contribute to a Malaysian’s debt.

In Malaysia, you can pay off credit card debt using the services of the Credit Counseling and Debt Management Agency (AKPK).

AKPK is an agency established by Bank Negara Malaysia to provide free financial counseling, debt management, and financial education to Malaysians.

Share your thoughts on TRP’s Facebook, Twitter and Instagram.