We Gave The New UOB TMRW App A Try & Loved It

The UOB TMRW app is a lifestyle partner that understands you and helps achieve your goals.

Subscribe to our Telegram channel or follow us on the Lumi News app for the latest stories and updates.

Look, we totally get it. Everyone’s a busy bee! And dealing with work, study, family, and trying to live your best life can be a pain…

With so much to do and so little time, you can’t afford to waste those precious moments at the boring bank, waiting in those boring lines, filling out some boring forms and talking to a boring teller.

What you need is a bank that gets you, supports your needs, vibes on your spectrum and lets you be the boss of your own money!

So if you’re looking to take your banking to the next level, have more control over your finances and manage your money the smarter, easier and faster way, and enjoy tonnes of perks all at the same time, then you definitely need to check out UOB TMRW— the new and improved, all-in-one banking app that’s all about YOU.

UOB TMRW is not your average banking app. It’s your personal AI-powered financial buddy that helps you save, spend and reward yourself LIKE A BOSS.

And since having it installed on my phone, it has made my financial life such a breeze. Here are some of the reasons why I personally love using the UOB TMRW app and why you should too!

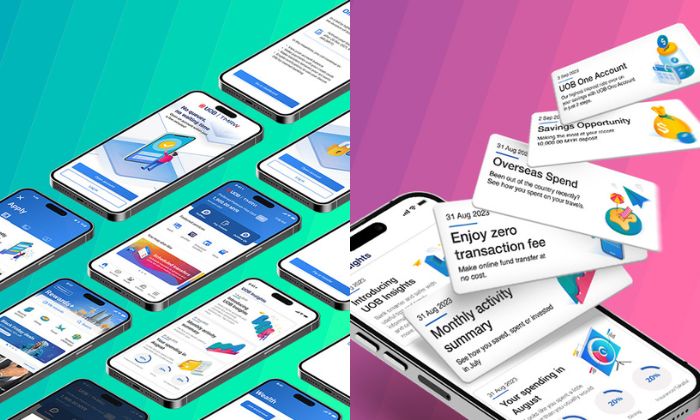

1. It’s super easy to get started!

Even if you don’t already have a UOB bank account, the UOB TMRW app lets you open your very own UOB savings account instantly without the hassle of walking to a branch.

Simply download the UOB TMRW app from the Google PlayStore, Apple AppStore or your device’s app gallery, have your Malaysian NRIC or MyKad ready for a quick photo verification, an initial deposit of just RM100, and with just a few taps you’ll be able to use the UOB TMRW app, today!

2. Pick an account that’s tailored to you!

With UOB TMRW, you can pick from four different savings accounts that are tailored to your personal needs:

- UOB One Account — it’s like having your very own ‘tabung’ that you can carry around with you and easily access anytime, anywhere without needing bundles of cash in your pockets. Plus you’ll get to enjoy up to 6% interest rate on your savings when you transact with your account.

- UOB Stash Account — stash your cash all in one place and enjoy even more interest, bonuses and rewards the more you save up! This allows you to grow by earning monthly interest by maintaining a balance at all times.

- UOB Lady’s Savings Account — a savings account specially made for the savvy ladies out there, complete with complementary medical insurance coverage for six different types of female cancers. Protect your money and your health all in one place!

- UOB ProSave Account-i — Keep your hard-earned cash completely Halal with a Shariah-compliant savings account that comes with complimentary takaful coverage of up to RM10,000.

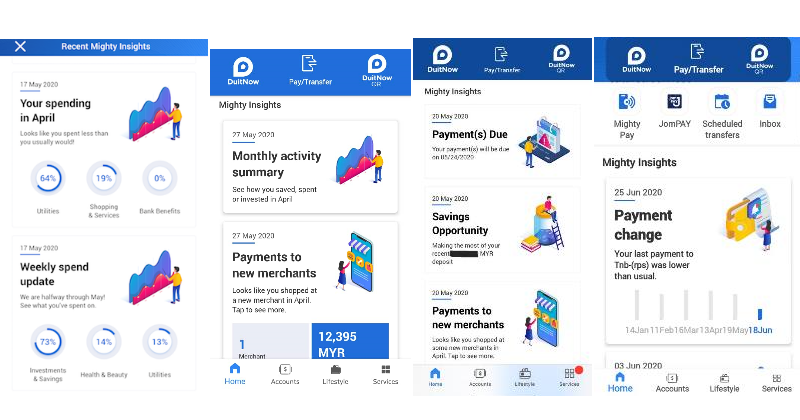

3. Have your very own AI-driven financial adviser in your pocket!

With UOB TMRW’s Insights, you’ll get your very own AI-powered assistant that helps you easily keep track of your savings and spending habits with personalised alerts, reminders and even recommendations to aid you in your financial and lifestyle goals.

Take full control of your finances and get notified whenever your paycheck comes in, when your bills are due, and whenever your account balance gets too low, as well as, a simplified breakdown of all your spending so you can see exactly where your money goes or if there are any discrepancies.

You can even get notified if you’re suddenly charged extra for any services you pay, providing extra peace of mind. It’s like having a personal financial adviser in your pocket!

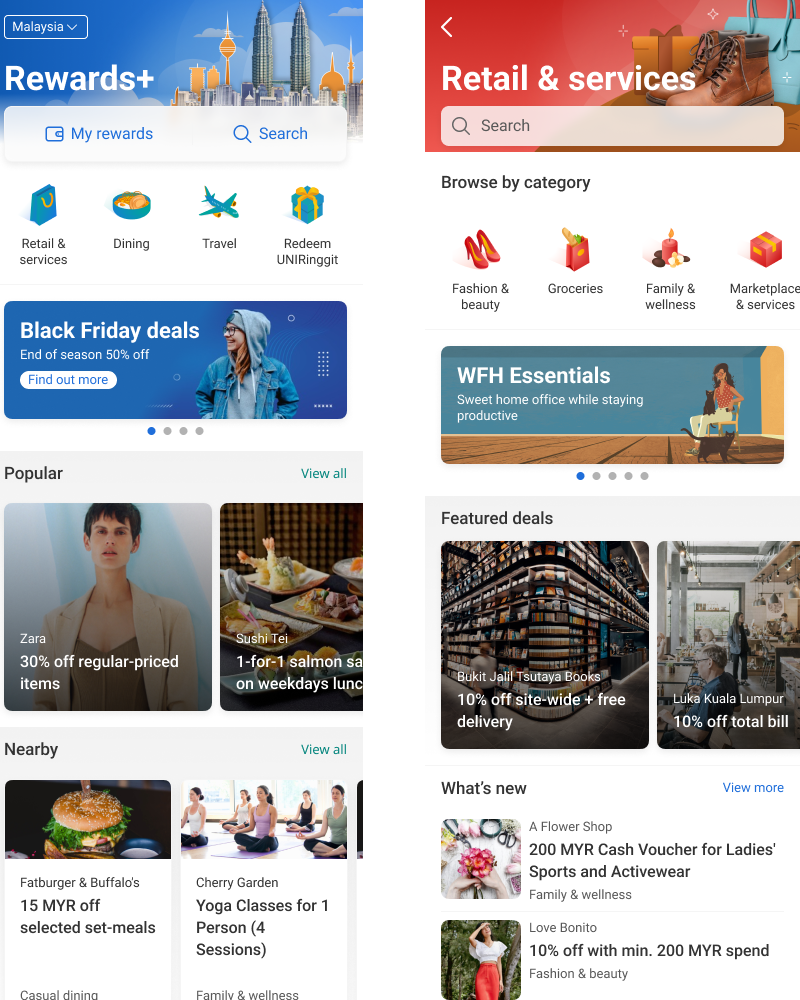

4. Spend & get yourself rewarded!

Get rewarded the more you spend your money with UOB’s Rewards+! Rewards+ is UOB’s newest and largest credit card rewards platform on the UOB TMRW app that lets you view, track and redeem rewards all from the convenience of your phone.

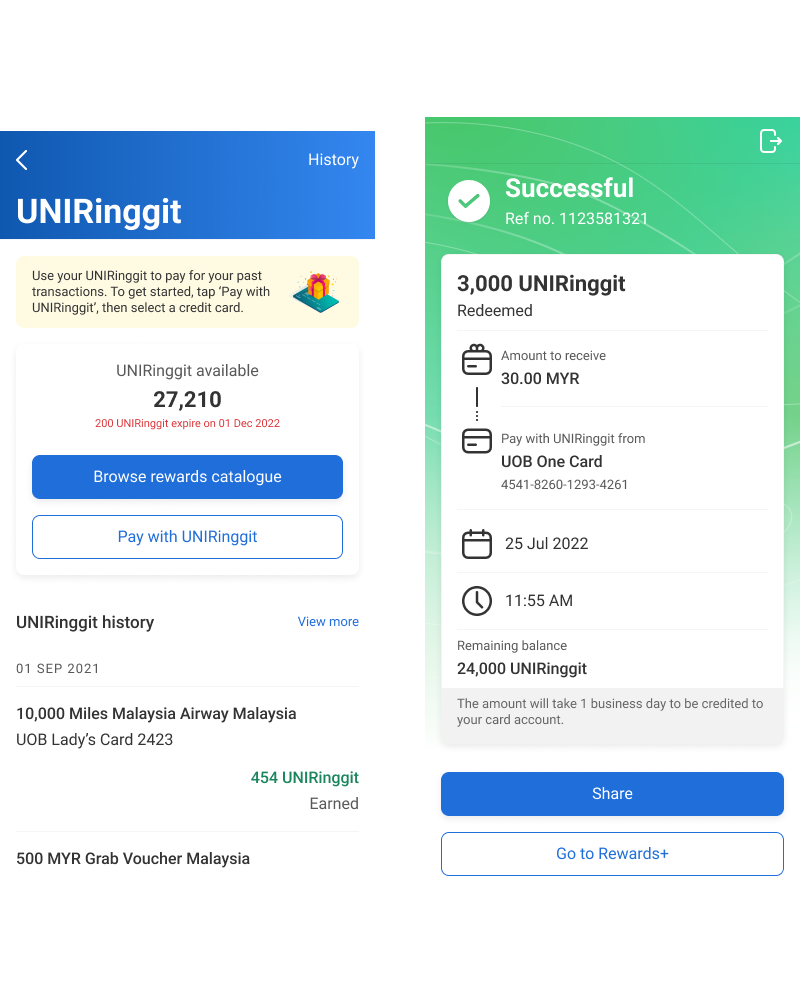

Every transaction you make with your UOB credit card will earn you UniRinggit which you can use to redeem special rewards and items from the UOB TMRW app’s rewards catalogue.

Have access to amazing retail, shopping, dining, travel deals and more, all in one place. Redeem coupons and even pay with the UNIRinggit you’ve earned, or get cash rebates with a tap of your finger. It’s that simple!

Having the UOB TMRW app has made my financial life so much easier and more enjoyable. It’s not just a banking app, it’s a lifestyle partner that understands me and helps me achieve my goals.

If you’re looking for a digital banking solution that suits your needs, you should definitely give the UOB TMRW app a try. Besides, wouldn’t you prefer to partner up with one of Malaysia’s top banks beloved by everyone in town? So what are you waiting for? Download the app now and make TMRW yours!

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.

Typing out trending topics and walking the fine line between deep and dumb.