Banks Auctioned Off Two Local Women’s Cars Without Informing Them

The banks sold off their vehicles after the women failed to settle their payments on time.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

Two local women have come forward to plead about their cars being auctioned off without their knowledge. The women claimed that their banks auctioned off their vehicles due to their failure to settle their payments on time.

One of the victims, Siti Adawiah Ismail, confirmed that it happened after she failed to pay the monthly installments for her Nissan Almera.

Siti was unable to pay the three months installments (from January to March) due to her anxiety disorder, as reported by News Straits Times.

But she argued that she had already paid RM60,000 for the car, which she purchased for RM65,000. Unfortunately, that did not seem to matter as she was approached by two men who repossessed her car.

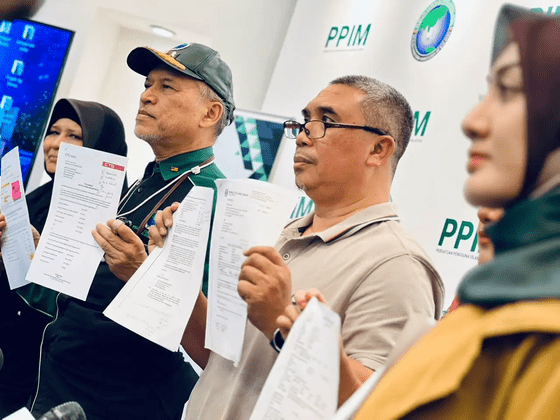

“The two men told me that they were going to repossess my car because I had failed to make the monthly payments for a period of three months before they showed me a piece of paper which they claimed was the repossession order from the bank,”

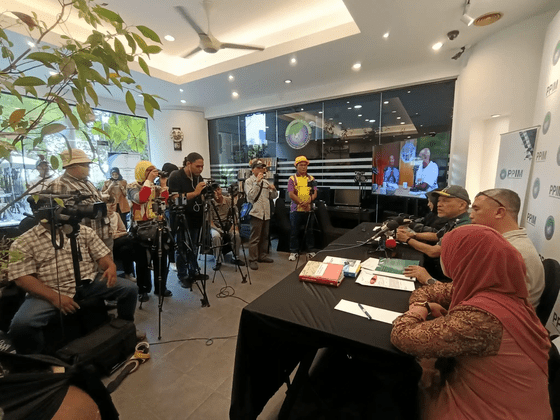

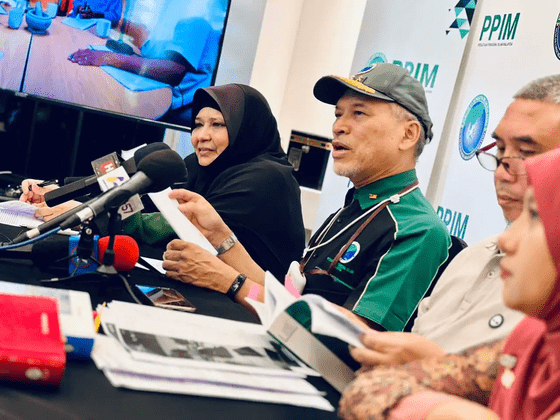

“I admitted that it was my mistake for failing to make the monthly installments, and I relented,” she told the reporters at the Malaysian Muslim Consumers Association (PPIM) headquarters.

She was then asked to cover the costs associated with bank processing, repossession, and more. However, she was unable to due to her financial constraints.

As such, her brother, who is her guarantor, was asked to pay the remaining balance of RM3,742 in August. But her car had already been sold to someone else in April.

“I did not receive any notification or information that the car had been auctioned off and when I asked the bank for an explanation, I was told that it was because I was behind in my repayments.

“I went to the Road Transport Department (RTD) and it was confirmed that the car’s registration number had another person’s name.

“However I was the one who was on the receiving end of the notice to renew the insurance and another check revealed that the car was still under my name.”

Hence, she was baffled and puzzled because the car was no longer hers anymore despite her making the full payment for the loan.

Second victim

This happened to another victim who purchased a Mercedes Benz from a used car company in KL. The victim, Hamshe, paid a deposit of RM93,000. But after failing to pay the installments for two months, her car was auctioned off.

“I contacted the financing company to request for a postponement or deferment in payment, but I was not entertained.” recounted the victim.

“During negotiations, the officer asked me to return the car and offered a cashback of RM10,000. I did not agree to it because I had already paid RM93,000.”

To make matters worse, the agent then requested she pay the outstanding loan and other costs, which amounted to RM20,000.

Hamshe said that she tried to negotiate but was not entertained before being informed that her car had already been auctioned off.

These incidents should not have happened as PPIM chief activist Datuk Nadzim Johan had insisted on an explanation from the banks.

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.