Good Or Bad? Opinion Divided Over Housing Loan Without Permanent Job And Pay Slip

The SJKP housing loan is a boon for homebuyers who do not meet the credit score traditionally required by banks.

Subscribe to our Telegram channel for the latest stories and updates.

Many Malaysians would want to own a home one day, and the government has made this easier.

People who do not have a permanent job and salary slip can make a housing loan under the Housing Credit Guarantee Scheme (HCGS).

The loan is made available through Syarikat Jaminan Kredit Perumahan Berhad (SJKP), which is wholly owned by the Ministry of Finance.

Prime Minister Datuk Seri Ismail Sabri Yaakob said the loan scheme is another government effort to help more people purchase their own homes, including those who have difficulty obtaining bank loans.

SJKP offers financing up to RM300,000.00 (including MRTA/ MRTT), with a 100 percent guarantee of total financing from participating financial institutions.

Properties that can be purchased under the loan scheme include Perumahan Rakyat 1Malaysia (PR1MA) housing.

Those without a permanent job and salary slip can apply with a confirmation letter from an authorised person.

The authorised person include Category A civil servant (Grade 41 and above), chairman of the Village Development and Security Committee (JKKK), the penghulu, elected representative and bank branch manager.

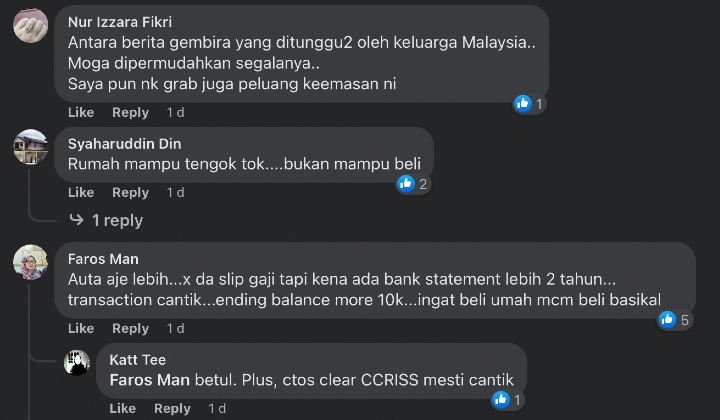

Opinions are divided on whether it is alright to give housing loans to buyers who lack good credit rating.

Those who supported the initiative praised the government as being caring and attentive to the needs of the people.

They said affordable housing needs to be a right, and not a privilege.

At the same time, those who support the loan scheme lauded its ease of application.

Are We Heading Toward A Subprime Mortgage Crisis?

Despite the seemingly good news, some pointed out that terms and condition still apply, such as Credit Reference Information System (CCRIS) record and debt-to-income ratio.

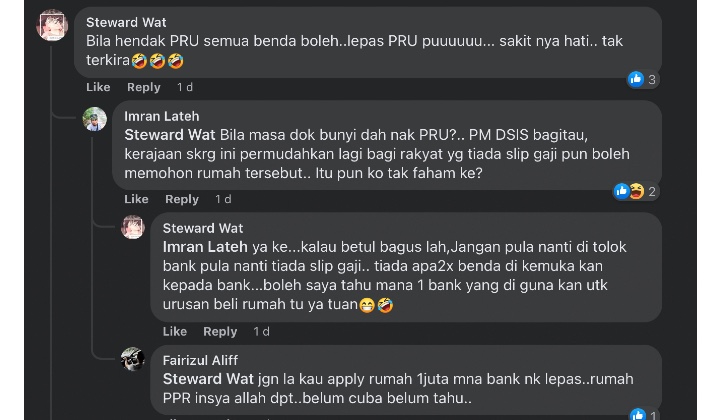

Some claimed it is nothing more than a populist move as election is near.

Others are doubtful if any banks would give out loans without payslips to support the application.

Some raised the issue of what will happen if the applicants default on the loans since they do not have a steady job, which is why banks refuse to lend in the first place.

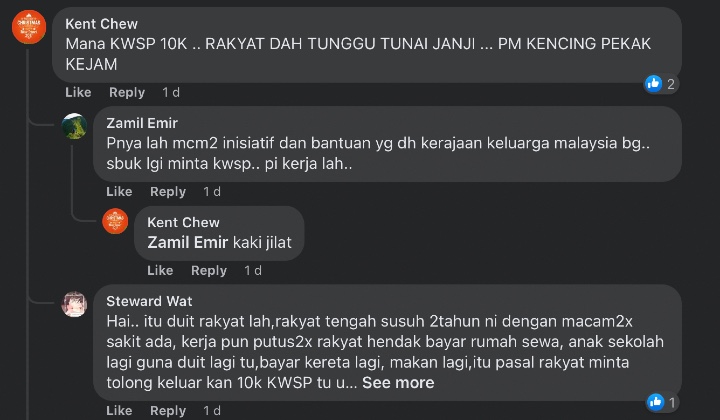

At the same time, some questioned why the government can loosened the conditions to get a loan, but not the withdrawal of one’s own saving from the Employee Provident Fund (EPF).

Real estate consultant and property management professional Calvin Chai Kuen Keong said it is generally much harder for people without steady job and low-income earners to get housing loan from banks.

The decision to purchase a property is a serious financial commitment that is not to be taken lightly. It will tie you to regular monthly payments for the next 30 years or more, hence banks would much prefer borrowers with a steady income. Banks hate bad debts as it would hit their profits.

Real estate consultant Calvin Chai on why borrowers ability to consistently pay their loan is important to banks.

Chai said potential homebuyers had always found it difficult to obtain mortgages if they do not meet the required credit score, as it means they generally have problems with debt.

As such, it would not be too far fetched to draw comparison to the subprime mortgage crisis that hit United States that lasted from 2007 to 2010 as homeowners defaulted on their loans.

The subprime mortgage crisis of 2007–10 was due to expansion of housing loans including to borrowers who previously would have had difficulty getting approval from banks.

Real estate consultant Calvin Chai on why banks deny loans to borrowers who are deemed high risk.

Chai said it would be more economically sustainable for the government to rent out affordable homes, with the option for the tenants to purchase the property once they are financially stable.

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.