RM1,000 Monthly Retirement Fund Falls Short, Warns Economic Expert

Economist Prof Emeritus Dr. Barjoyai Bardai asserts that RM240,000 is insufficient to provide a comfortable post-retirement life.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

Establishing a fundamental retirement fund for the later years is a vital aspect of financial planning, especially in light of increasing living costs.

While some retirees may not have substantial savings, it offers a degree of financial security as they navigate their retirement years.

RM240,000 for 20 Years Post-Retirement Proves Inadequate

Nevertheless, did you know that having RM240,000 as a basic fund for a 20-year post-retirement period is inadequate to meet the escalating cost of living?

According to Prof Emeritus Dr. Barjoyai Bardai, this sum doesn’t suffice for a comfortable retirement.

He explains that dividing RM240,000 over 20 years results in retirees having only RM1,000 at their disposal each month.

“This amount is insufficient because the monthly food expenses for Malaysians range from RM800 to RM1,200. So, the allocated sum of RM1,000 is barely enough for food. What about housing costs, utilities, clothing, and the like?

“In this regard, RM1,000 is woefully inadequate. In fact, it’s even lower than the minimum wage of TM1,500. A family needs at least RM3,500 per month,” he stated, as quoted by Berita Harian.

RM240,000 Basic Retirement Savings for a Dignified Retirement, Advises Ahmad Maslan

In a previous statement, Deputy Finance Minister I, Datuk Seri Ahmad Maslan, urged citizens to aim for a minimum of RM240,000 in basic savings by the time they reach the age of 55.

He underscores the importance of Malaysians having sufficient retirement funds to ensure a dignified retirement.

Ahmad Maslan Proposes Various Saving Methods

To achieve this goal, Ahmad Maslan suggests several methods to reach the minimum RM240,000 savings threshold as one approaches retirement age.

These strategies include seeking employment in companies offering higher salaries and making voluntary contributions.

Additionally, he recommends employees in the informal sector to save through the i-Saraan scheme introduced by the Employees Provident Fund (EPF).

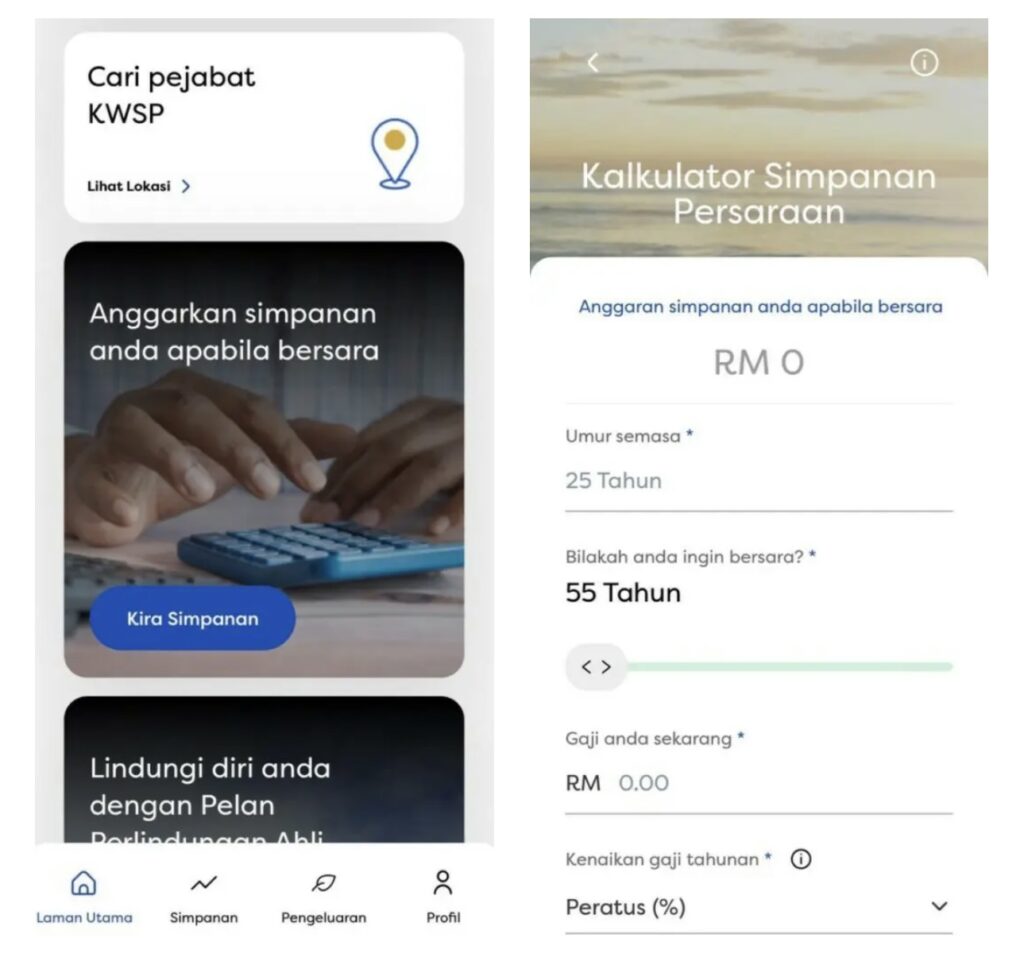

The KWSP i-Account app can estimate your retirement savings, helping individuals assess their preparedness for a dignified retirement.

Those interested in evaluating their retirement prospects can access this app on the App Store, Google Store, or AppGallery.

READ MORE: 71% of Malaysians Save Less Than RM500 Monthly

READ MORE: Left With Only RM2 In Wallet – Netizens Share Gritty Moments Facing Financial Hardship

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.