Asia Needs More Accountants Because There Are Too Many Rich Kids

Amidst wealth transfer, there’s a growing need for skilled professionals overseeing family offices, entrusted with vast generational wealth.

Subscribe to our FREE Newsletter or Telegram channel for the latest stories and updates.

Amidst the demand to manage and transfer wealth across Asia, there is a growing need for skilled accountants due to the proliferation of affluent families and the rise of family offices. As the competition intensifies, professionals from various backgrounds are delving into the ABCs of family offices, institutions tasked with overseeing vast and secretive pools of generational wealth.

Governments and educational institutions worldwide are grappling with the rising demand for qualified individuals in the wealth management industry.

WEALTH TRANSFER

Asian family offices have witnessed a remarkable surge, marking the region’s maturing fortunes as local money continued to grow post-colonialism. Many successful entrepreneurs, now immensely wealthy, are focused on preserving and transferring their wealth to future generations, akin to the long-standing practices of old-money families in Europe and the US.

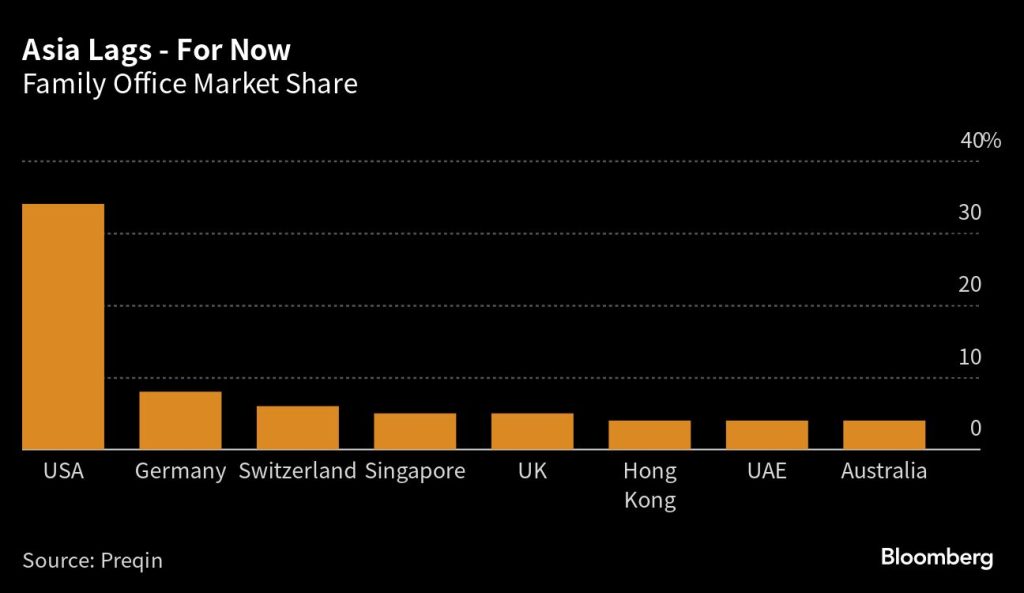

The statistics from Campden Research’s Asia-Pacific Family Office Report reveal that around 80% of family offices in the region were established after the year 2000, signifying the recent rapid growth of the industry. Managing nearly $6 trillion in 2019, the family office industry has only expanded since then, with projections by HSBC Holdings Plc suggesting that by 2025, Asia’s financial wealth, excluding Japan, could surpass that of the US.

“Asia has tremendous growth potential,’’ said Rebecca Gooch, global head of insights at Deloitte Private in London. While the region only accounts for a fifth of all family offices, it’s the fastest-growing market in the world, she said.

The escalating demand for family offices in Asia has prompted comparisons to a tsunami, and experts foresee the region’s financial wealth potentially overtaking Europe in the next few years. As a result, financial hubs like Hong Kong, Singapore, and Dubai are striving to capitalise on the trend.

Hong Kong offers enticing tax and residency incentives to attract families seeking investment opportunities in China, while Dubai has set up a specialised centre to cater to the needs of wealthy families.

Singapore, having recognised the potential early on, offers tax breaks and other perks, which has led to a substantial increase in the number of family offices in the city-state. By the end of 2022, it had approximately 1,100 family offices, compared to just 400 in 2020, and there are indications of continued growth.

As the family office industry booms, there has been a surge in training and certification programmes for individuals aspiring to work in this sector. The Wealth Management Institute in Singapore, founded by state investors GIC Pte and Temasek Holdings Pte, provides a programme for certifying family office practitioners.

However, finding suitable employees for family offices is a unique challenge. Despite the abundance of unemployed bankers due to downsizing at major financial firms, family offices have strict selection criteria and value trust and confidentiality above all else.

These offices require employees who can manage various aspects of a family’s life, from investments to philanthropy and travel across multiple continents. Hence, the hiring process for family offices remains highly selective and cautious.

Being great at a finance job doesn’t always translate well to this line of work. Three family office principals recently shared their unconventional criteria for ideal hires, adding a fresh perspective to the hiring process.

While discretion remains a non-negotiable trait, the desire for more unique skill sets came to the forefront. One principal expressed a preference for candidates with high proficiency in Mandarin and a profound appreciation for the artistic brilliance of American painter Jean-Michel Basquiat. Another said the ability to mediate among squabbling siblings was a priority.

Despite the proliferation of educational opportunities in the financial realm, industry insiders underscore the significance of practical experience and soft skills over mere technical know-how.

According to Manish Tibrewal, formerly associated with the Tolaram Group’s family office and now the founder of Farro Capital, a multi-family office based in Singapore, professionals need to cultivate a genuine connection with the family, which can only be achieved through time and experience.

“The soft skills outweigh the hard or technical skills since the latter can be readily imported or outsourced,” he remarked, highlighting the indispensable value of emotional intelligence and adaptability in the family office environment.

Asia faces a dearth of professionals with experience in this area, said Paul Westall, co-founder of Agreus, a family office recruitment firm. This scarcity underscores the importance of transforming the vast pool of finance executives into versatile and discreet professionals, meeting the soaring demand for their unique skill sets.

Amidst the ongoing accumulation and transfer of wealth within Asia’s affluent families, the race for adept finance professionals to manage these substantial riches is set to intensify. This lucrative sector boasts top-tier positions commanding salaries exceeding $1 million, but navigating it requires a distinct set of skills and adaptability.

“If someone needs to pick the mail up or make a cup of coffee for the principal’s friend then you may be required to do that,” Westall said, noting one finance-trained head of a family office is working on the design of a client’s office.

“Some people are just not going to be right for that.” Evidently, not everyone may possess the aptitude or inclination for such multifaceted responsibilities.

The challenge of hiring suitable candidates is particularly acute in locations like Singapore, where companies must maintain a minimum headcount to avail of tax exemptions and other advantages, despite a remarkably low unemployment rate of just 1.9%. Similarly, Hong Kong’s labour market also faces tight conditions, with a jobless rate of 2.9%.

If a country lacks sufficient talent, “then a functional family office cannot be established,” said Angel Chia, the chair of the Family Office Association Hong Kong. The establishment of a functional family office becomes an elusive goal.

The future promises a continuously expanding and dynamic financial landscape for family offices in Asia.

The above was inspired by a piece written by David Ramli of Bloomberg, which can be found HERE

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.