Dynamic Card Number: The Secret Shield Against Online Scammers

Alliance Bank’s Visa VCC and DCN are the dynamic duos of financial security.

Subscribe to our Telegram channel or follow us on the Lumi News app for the latest stories and updates.

In the hustle and bustle of Malaysia, scams, data leaks, and credit card fraud are on the rise. It’s like the bad guys are having a field day.

But fear not. Alliance Bank emerges as the ultimate hero, armed with a game-changing solution: the Virtual Credit Card.

So, picture this – you’re chilling at home, sipping on your favourite drink, and the urge to make an online purchase hits you. But wait! You don’t want to risk your precious credit card information falling into the hands of those sneaky cyber crooks. That’s where Alliance Bank’s Visa Virtual Credit Card swoops in to save the day!

But what is a Virtual Credit Card?

Okay, let’s break it down. A Virtual Credit Card (VCC) is like a digital fortress that shields your real credit card number – like having a secret identity for your credit card. Pretty cool, right?

Instead of exposing your actual credit card number online, you generate a Dynamic Card Number (DCN) with 16 random digits. It’s like sending a secret agent to handle your risky transactions while you relax in your pyjamas.

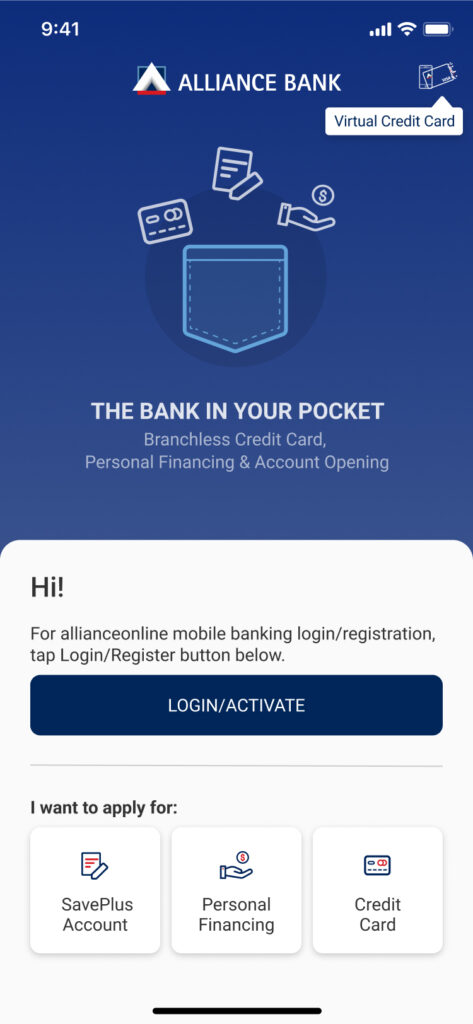

Now, let’s talk about Alliance Bank’s Visa Virtual Credit Card. It’s the digital counterpart of a real credit card, but way cooler. All you gotta do is download the allianceonline mobile app, tap on VCC, provide your deets, and wait for the approval. Once you’re approved, brace yourself for some serious superpowers.

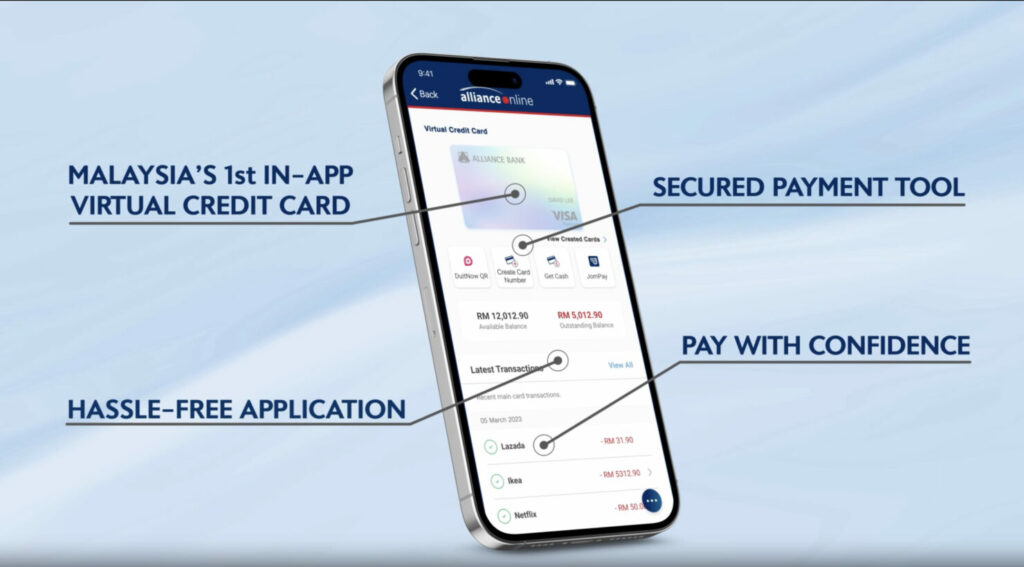

With the VCC, you can create a new DCN with just a tap. Want to make a one-time purchase? Click “Create Card Number” then choose “One-Time Card” and you’re good to go. It’s disposable and only lasts for 30 minutes. So, even if sneaky scammers get their grubby hands on your DCN, they won’t be able to use it for their own devious plans. But wait, there’s more!

You can even set up subscriptions, like Netflix, or e-billings like Air Selangor or TNB bills. You can also set spending limits, choose an expiry date and even colour-coordinate your subscription DCNs. It’s like being the boss of your own digital kingdom!

Here’s another cool thing about Alliance Bank’s Visa Virtual Credit Card – you only get charged with a RM25 SST once a year for your VCC Static Card. So, you can create as many DCNs as you want, and keep those transactions flowing without worrying about extra fees.

Oh, and if you ever sense some suspicious activity or just want to play it safe, you can freeze or unfreeze your DCNs instantly through the app. But as an added security feature, you can only use the allianceonline mobile app on 1 device. So, choose the device that will be your primary device.

Tap into the future of financial security

In a world plagued by scams and frauds, Alliance Bank’s Visa VCC and DCN are the dynamic duos of financial security. They’re like Batman and Robin, but for your financial well-being. With disposable card numbers and the power to freeze or unfreeze them whenever you please, you can finally breathe a sigh of relief. Online shopping and transactions just got a whole lot safer and easier.

The future is here, and it’s secure, convenient, and oh-so-awesome. So, what are you waiting for? Take the leap, embrace the power of the VCC and DCN, and let Alliance Bank be your trusted partner in this thrilling digital adventure. Your financial peace of mind is just a tap away.

Click HERE and watch the video below to find out more about Alliance Bank’s VCC!

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.