Electricity (Below 600kwh) And Water Remain Exempt From SST Hike

The government’s decision to exempt essential services demonstrates a commitment to mitigating the impact on Malaysians’ cost of living.

Subscribe to our FREE Newsletter, or Telegram and WhatsApp channels for the latest stories and updates.

In a move lighting up conversations from the coffee shops to the corridors of power, Malaysia’s Minister of Communications and Digital, Fahmi Fadzil, has flipped the script on the Sales and Services Tax (SST) narrative.

Amidst the swirling rumours and heated debates over the telecom sector’s SST exemption, Fahmi has stepped in with a clarification that’s as refreshing as a cold drink on a hot Kuala Lumpur afternoon.

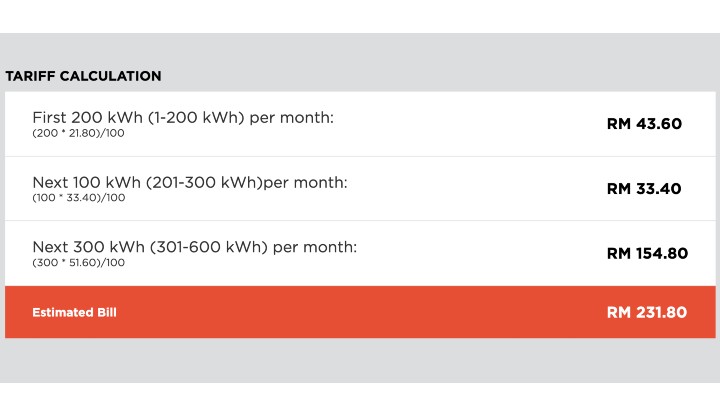

Electricity consumption under 600 Kilowatt-hours (kWh) and water services, it turns out, have been living a tax-free life all along, untouched by the SST’s reach.

This revelation came packaged in a sleek, easy-to-digest poster shared by Fahmi on the social media platform X, formerly Twitter.

The infographic breaks down the upcoming SST increase set for March 1st, reassuring citizens that their essentials will remain unaffected.

Your food, drinks, parking, telecom services, and even late-night snack deliveries are safe from the taxman’s grasp.

Ada yang persoal, kenapa sektor telekomunikasi je diberi pengecualian kenaikan cukai perkhidmatan? Kenapa tak kekalkan cukai perkhidmatan 6% juga kepada perkhidmatan elektrik dan air?

— Fahmi Fadzil 🇲🇾 (@fahmi_fadzil) February 28, 2024

Jawapannya, sebab perkhidmatan elektrik bawah 600 kWj dan air tak ada cukai perkhidmatan pun… pic.twitter.com/aLq7Wnpgsz

The plot thickened last October when Prime Minister Datuk Seri Anwar Ibrahim unveiled plans in the 2024 Budget to hike the SST from six to eight per cent.

But fear not, for the essentials of life in Malaysia—ranging from your morning teh tarik to your essential internet connectivity—remain untouched.

Feeling the Pinch: SST Increase Sparks Cost of Living Concerns

The backdrop to this story is a broader public concern over the SST hike.

This sentiment echoes past frustrations with taxation under previous administrations, notably the Goods and Services Tax (GST) introduced by former Prime Minister Datuk Seri Najib Razak.

The GST, a broad-based consumption tax implemented in April 2015, was criticised for increasing the cost of living, leading to its repeal and replacement with the SST in September 2018.

Kerajaan sekarang yang naikkan SST & Hapuskan GST, Najib dalam penjara yang kau blame? 😂 https://t.co/1xukq2BFEE

— Arif Azami (@baldlifter) February 3, 2024

Malaysians’ sensitivity to tax changes stems from their impact on everyday expenses.

Citizens are drawing parallels between the SST’s potential effects on their daily lives and the financial strain many experienced under the GST regime.

The comparison underscores a deep-seated apprehension towards policies perceived to elevate living costs, particularly in a post-pandemic economy where many are still finding their footing.

Share your thoughts on TRP’s Facebook, Twitter, and Instagram.