What Is Loss Of Use And How Can It Help You Save Money?

CART can be claimed even if you do not have a comprehensive insurance package.

Subscribe to our FREE Newsletter or Telegram channel for the latest stories and updates.

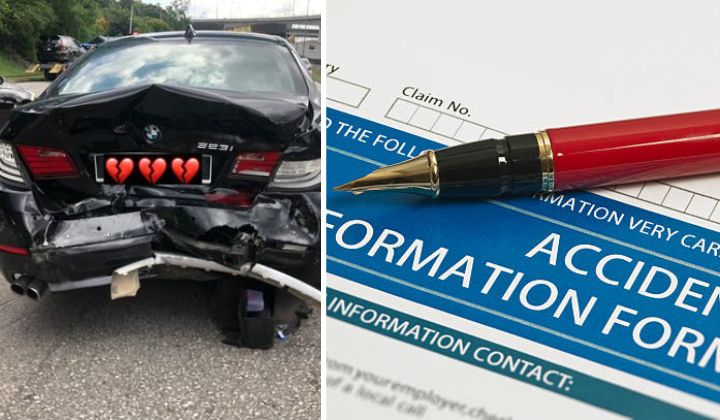

Whenever there is an accident, the first step is to make a police report. Contrary to popular belief, the first step is not to argue and fight by the roadside.

After lodging a police report, proceed to inform the insurance company so that the claim process can be carried out.

However, how many of us are aware of the fact that we can also claim for “Loss of use”?

Recently, Tiktok user @matboroi 71 spoke about “Loss of use” citing information from Facebook user Fatiha Ziqra.

@matboroi71 ♬ original sound – matboroi71

Mat Boroi claimed that this was something often manipulated by insurance agents and adjusters for their own profit.

According to Fatiha Ziqra’s Facebook post, after some battle, she did manage to receive the claim that was within her rights.

Loss Of Use

According to the video, this claim is similar to having a medical card. If you are a medical card holder and you are admitted to the hospital, then you are entitled to claim a sum of compensation for the days that you won’t be able to work.

It is the almost the same system, but it is used for vehicles.

According to the Pacific & Orient Insurance Co, the term “Loss of Use” is the same as CART (Compensation for Actual Repair Time).

The website Bjak said this particular claim comes under two categories which are Own Damage Knock-for-Knock claim and Third-Party claim.

How do these claims work?

You can file an Own Damage Knock-for-Knock claim on your own comprehensive insurance if a third party was at fault for the collision without it having an impact on your No Claim Discount (NCD).

With this, you can utilise the accident-causing party’s insurance to make a claim for the excess and loss of use. You can also repair your vehicle more quickly.

However, if you do not have your own comprehensive insurance, then you can go for the Third-Party claim.

With this, you can get compensation for CART, depending on the estimate of the insurance adjuster as to how many days it will take to fix your vehicle. Keep in mind that insurance providers may grant an additional seven working days if a sudden or unavoidable delay occurs.

You would also be able to get compensation for extra automobile rental fees for the number of days the suggested repair will take place.

The CART is calculated according to type of vehicle and their engine capacity (CC):

This piece of information is vital for all of us to know as it saves a big dent in our wallet and also, it is within our rights to claim.

Share your thoughts with us via TRP’s Facebook, Twitter, Instagram, or Threads.