Be ‘Bijak’ About Your Money With Be U

Bank Islam introduces the Be U mobile app, Malaysia’s first 100% Islamic digital bank.

Subscribe to our Telegram channel for the latest stories and updates.

Everyone dreams of having the financial freedom to spend, save and invest in a certain lifestyle. But navigating the financial world can be challenging, especially when you’re the new kid on the ‘adulting’ block. After all, there isn’t exactly a school subject teaching youths how to manage their cash, apply for credit or stay out of debt.

RinggitPlus’ 2021 Malaysian Financial Literacy Survey summarised that the country’s youth have poor personal finance habits but are more digitally savvy compared to the rest of our population.

This would certainly mean that having modern tech, like mobile applications, is a good way to educate the younger generation on the value of being frugal with their finances and helping them achieve their financial goals.

The friendliest digital bank in town!

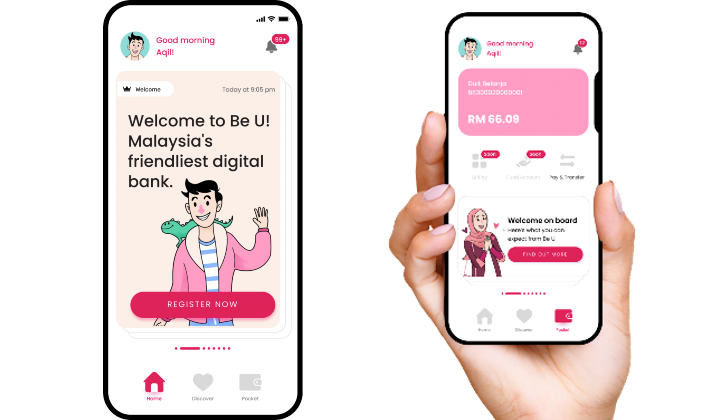

With Malaysia’s digital-savvy Gen Zs in mind, Bank Islam introduces the Be U mobile app—Malaysia’s first 100% Islamic digital bank.

Be U is built as a friendly and easy-to-use digital banking solution to help users manage their money and improve their financial habits.

What can Be U do for U?

Be U provides users with a seamless banking experience without the hassle of visiting brick-and-mortar branches.

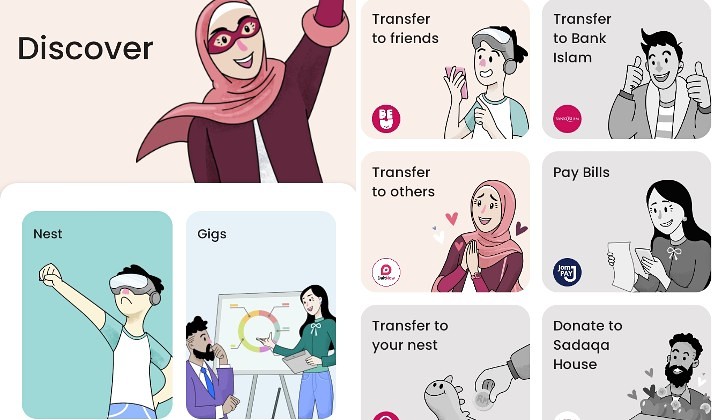

With Be U, users can instantly open an online ‘Be U Qard Savings Account-i’ and immediately get access to convenient services and features to help simplify and amplify Ur lifestyle like;

- Be U’s ‘Pocket’ to quickly transfer money to friends and family, and view your transactions.

- Be U’s ‘Nest’ to set aside some funds for future needs. You can build up to 7 nests and fill em’ up at your convenience.

- Be U’s ‘Gigs’ to earn extra income and explore opportunities.

And the best part is that unlike other digital banking offerings out there, U don’t need to be an existing Bank Islam customer to be on Be U!

Any Malaysian over the age of 18 is eligible for a Be U Qard Savings Account-i with the use of any bank account opened in Malaysia—whether it’s a Malaysian bank or an international bank that operates in the country.

All U need to do is download the Be U app from Google Play or the Apple App Store, and simply register and validate your details to get Ur-selves started on your Be U journey.

Is Be U Safe and secure?

All products and offerings are issued by Bank Islam, whose history goes back 40 years, so there’s reassurance that an established financial institution is backing this mobile-only bank.

As Bank Islam is fully regulated by Bank Negara Malaysia (BNM), all offerings including Be U By Bank Islam follow standards and regulatory requirements to make sure your funds are protected.

Be U Qard Savings Account-i will also be covered by PIDM (Perbadanan Insurans Deposit Malaysia) for up to RM250,000 per depositor.

Furthermore, users can secure their Be U accounts with passwords and biometric verification set on their mobile devices.

At the same time, Be U Qard Savings Account-i holders can also relax knowing there’s no need to keep any balance in their account for it to remain active!

Ur digital banking BFF!

Accompanying users on Be U is Aqil—the app’s friendly mascot!

Aqil will be your guide to help you get started on the Be U app and also pops up to remind you to keep your private info secured every time you take screenshots on the app.

Be-yond Ur regular banking app

Be U is set to roll out fast updates and even more fantastic features to solve users’ financial and lifestyle needs like make online payments via QR codes, pay bills, apply for microfinancing and term deposit options, debit cards and much, much more!

Stay tuned for more updates about how Be U can Be Ur new banking BFF.

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.

Typing out trending topics and walking the fine line between deep and dumb.