Navigating Uncharted Waters: A Gen Z’s Guide To Safeguard Your Future

In light of this inflationary period, young Malaysians agreed that they need financial protection and support to get some peace of mind.

Subscribe to our Telegram channel for the latest stories and updates.

Gen Zs love to live young, wild and free. The ideal lifestyle for young ones is to build experiences and live our best lives, now and in the future. But inflation is making us work harder to achieve this.

Everything from the food that nourishes us to the houses we make homes, and even our desires to live healthy lifestyles can feel like a heavy burden.

In May 2022, the country’s inflation rate increased to 2.8%. This is proving to be a burden for Malaysians, as the majority are said to struggle to raise even RM1000 for emergencies.

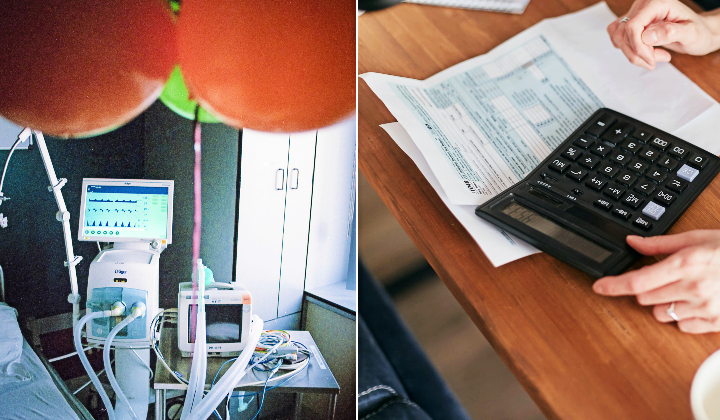

With Malaysia’s medical inflation rate ballooning to 107% in the last 15 years, even the healthcare sector is fighting to stay afloat.

Medical inflation basically means that the costs of medical services increase over time. With the rise of new technologies, medications and treatments, and just the general cost of living, the cost of healthcare treatments and services increases as well.

But, with the right financial plan in place, it’s possible to lighten the load and live the life we want.

TRP’s street-style survey of KL’s youngsters found that most of them are aware of the inflation we are experiencing in this country, but they have no clue what medical inflation is. Despite having difficulties balancing their books with today’s cost of living, Gen Zs do realise the importance of managing their finances and having an umbrella ready for rainy days.

One Gen Z we interviewed said:

I think it’s necessary because we don’t know what will happen in the future.

Some of them also agreed on the importance of having medical insurance and have considered taking up an insurance plan as a countermeasure form of protection, because life is unpredictable and things could take a turn.

Another person we interviewed mentioned:

Yeah, I’ve been thinking of getting insurance recently. It’s the feeling of being safe.

Even the private sector is taking note and adapting to this changing landscape. For example, Prudential is invested in helping every Malaysian make smart financial choices now to manage their medical expenses and safeguard their savings should any medical emergencies happen in the future.

There’s no better plan than one that grows with you – like Prudential’s Medical Booster Solution, with which you can be sure that the investment you make for your health today, lasts you for a lifetime.

Prudential can provide protection that grows with you.

In light of this inflationary period, the country’s young adults agreed that they need financial protection and support to get some peace of mind.

Prudential Medical Booster Solution is a plan that ensures your coverage is guaranteed to increase as you age even if you have made a claim before. Despite medical inflation and healthcare expenses going up, your coverage goes up as well.

Starting with an annual limit of more than RM1 million, you can enjoy an auto increase of your annual limit up to RM 150,000 every year without underwriting, which adds up to an annual limit of RM15 million.

So for example, if you start this plan at 23 years old, you’ll start with an annual limit of RM1 million and end up with an annual limit of RM2.05 million when you’re 30!

Prudential can provide comprehensive recovery coverage through it all.

Illnesses and accidents strike with no warning. It’s a bitter pill to swallow, but suffering a serious illness or major accident requires a longer recovery period, which equals high medical expenses throughout recovery.

It is reported that in 2020 alone, Malaysians spent RM23.15 billion out of their own pocket for medical expenses, ranging from outpatient, inpatient, traditional complementary and alternative medicine treatments, as well as pharmaceuticals and medical supplies.

When asked what are the key things they look out for in medical insurance, most Gen Zs claimed that they want comprehensive coverage and not just covering hospitalisation fees.

One Gen Z we talked to said it best:

Well, insurance is supposed to protect us.

Prudential understands the need for you to have peace of mind by not just getting the best treatment and care during hospitalisation, but also your pre-hospitalisation and post-hospitalisation process.

The Prudential Medical Booster Solution extends your pre-hospitalisation and recovery benefits to support your recovery process through ailments and serious conditions. Instead of worrying about your finances, the Medical Booster Solution gives you an increased number of pre-hospitalisation coverage to 90 days.

It also covers your post-hospitalisation, which includes prescribed outpatient physiotherapy treatments for serious conditions for up to 365 days upon discharge, so that you can focus on recuperating and getting back in the pink of health.

The recovery process is not an easy stage to get through. Prudential’s Medical Booster Solution takes the burden of heavy medical bills off your shoulders so that you can ‘get well soon’ knowing that all your hospitalization fees and ICU stays are taken care of.

Prudential also rewards you for staying healthy!

When young adults think about health investments, they often think that it’s just about taking care of themselves by eating clean, working out and taking supplements.

That’s good practice, but what’s better is having Prudential’s Medical Booster Solution that provides you with a preventive care benefit to protect, prevent and postpone the onset of diseases, so that you can reap the rewards of maintaining a healthy lifestyle.

With the Medical Booster Solution, you can be reimbursed up to RM1,000 for preventive care if you have not made any claims in the previous year.

This ‘no-claim’ benefit can be used for vaccinations, medical check-ups, diagnostic tests or paying for your subscription plan of Pulse by Prudential Health App’s digital health app.

As Gen Zs, making smart health investments today can provide you with all the freedom to live young and wild – while stepping into a safer and brighter tomorrow. Find out more about Prudential’s Medical Booster Solution or talk to a Prudential Life Planner to help you plan for the future, now.

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.