Vincent Tan’s BMF Wants To Build 5-Bedroom 900sqft Apartment, Suggests 60 Year Loan As “Affordable Housing”

BMF said the government, banks, should be involved it this but Malaysians online are not sold on the idea.

Subscribe to our Telegram channel for the latest stories and updates.

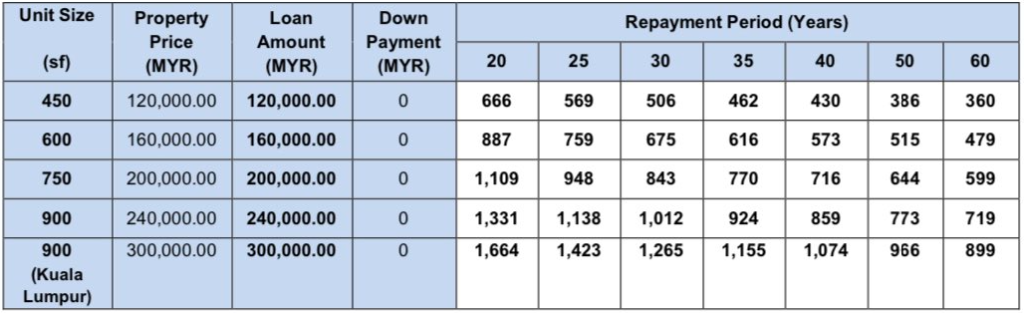

Affordable housing can be priced from RM120,000 to RM300,000 for apartments with sizes starting from 450 sq ft up to 900 sq ft in the Klang Valley, said Better Malaysian Foundation (BMF).

Formerly known as the Vincent Tan Foundation, the social enterprise programme thinks that it’s achievable with government support in terms of lowering land premiums and nominal development charges for affordable housing projects.

It’s reported by Malay Mail that the foundation has submitted the proposal to the government and is currently being studied.

BMF’s affordable home plan

Based on a press release tweeted by Berjaya Corp Bhd’s Chief Executive Officer (CEO), Abdul Jalil Abdul Rasheed, BMF said that Federal and State governments can also contribute by selling development land at low costs to developers to build affordable housing projects – especially in urban locations close to transportation hubs, which would translate into lower purchase prices for low-income house buyers.

Another suggestion is for the government to guarantee the home loans of B40 house buyers so that such loans can be offered at a lower interest rate, and home loan applications will be more readily approved by banks and financial institutions.

They said that this important as these loans will effectively be “double secured” over the property itself as well as by the guarantee.

(1) Affordable housing is a chronic problem globally. Much of the problem is due to pricing which does not match median income of population. pic.twitter.com/gSfH5KD2HP

— Jalil Rasheed (@jalilword) April 29, 2021

Tiny homes… with 60-year loan tenure?

BMF said that loan applications of 60% of buyers of affordable homes are rejected by banks and financial institutions due to age or poor credit scores and many first-time buyers from the B40 group are not able to pay the usual down-payment on a home purchase.

What they’re suggesting is for lenders to give 100% financing and also multi-generational loans which they say would resolve this issue.

Housing loans should also be “two-generation” loans with terms of between 40-60 years where loan repayments can be extended over two generations to ensure that monthly repayment instalments are affordable and manageable and there is still sufficient disposable income left to provide the household with a decent standard of living.

BMF via Twitter

They also said that mortgages should be adjusted to make it affordable for the B40 income group.

We set out below a monthly mortgage repayment schedule showing the amounts of monthly repayments based on different amounts of housing loans taken out over a term ranging between 20 years to 60 years at an interest rate of 3% per annum with 100% financing.

BMF via Twitter

Malaysians online aren’t sold on the idea

People online weren’t too thrilled to see the 40 to 60 year financing term or the idea of passing down the debt on to their children.

Malaysia is becoming US junior. So many vacant buildings; old hotels, bankrupt malls etc. All can be converted into residential units for B40. But nope, we prefer to build new buildings and “allow” them to pay 600k+ over the course of 60 years for a 900sqft box. https://t.co/UZqyte8sOX

— grand high witch (@penatbuttercup) April 30, 2021

One user even pointed out that if BMF wants to solve the housing issue, they should look at other issues such as vacancy tax – a type of tax imposed on vacant and unused units which has been put on hold by the government.

The more i think about this the more i’m not a fan of the solution. If BMF is serious about addressing this they should lobbying for vacancy taxes and price ceilings. Show us the breakdown for development costs and see how much profit developers are making. Benchmark it globally https://t.co/ZnAB8Cvug7

— Nabil Ersyad (@NabilErsyad) April 30, 2021

Another user even did the math and found out the possibility of buyers having to pay double the actual property amount after multiplying the monthly loan amount.

Property price: RM300,000

— dengki ke? (@azmirliberty) April 30, 2021

The amount you pay if you take a 60-year-loan: RM899 x 12 x 60 = RM647,280

Wow this helps B40 a lot! 😏 https://t.co/8ZC9bsdNMl

Share your thoughts with us on TRP’s Facebook, Twitter, and Instagram.

Unkempt in both stories and appearance, Hakim loves tech but tech left him on read, previously he used to write about tall buildings and unoccupied spaces that he can't afford, and legend has it that he still can't afford it to this day