Kelantan Man Denied Motorcycle Loan In The Face

The man questioned what have Kelantanese done wrong that they are profiled in such a manner.

Subscribe to our Telegram channel for the latest stories and updates.

“What happened to Kelantanese people? Why did the staff refuse my loan without looking at the application documents?”

Recently, a man complained on social media of a troubling tale when he was applying for a motorcycle loan.

When the person in charge learned that he was from Kelantan, he rejected his loan application without reviewing any documents, which made him very disappointed and called out: ” What did Kelantan people do wrong? Why is it so difficult to apply for a loan?”

He also shared a video on TikTok showing a WhatsApp voice message from a woman, believed to be an employee who is in charge of offering vehicle loans.

@buzy24hour Habis la lepasni orang klantan susah dah nak buat loan😂😂😂

♬ bunyi asal – Perantau – F@S

The woman said, “Excuse me, are you from Kelantan? Sorry, sir, our company does not accept loans from Kelantanese.”

The voice and video of the man being unfairly treated quickly spread on the Internet and caused heated discussions among netizens.

Kelantan Applicants Rejected At Higher Rate

Everyone expressed solidarity and said that if the owner does not want to borrow money, he can borrow from the west.

“It’s okay, this one doesn’t work, just find someone else who is willing to accept the application! Just ignore this kind of person,” said one netizen.

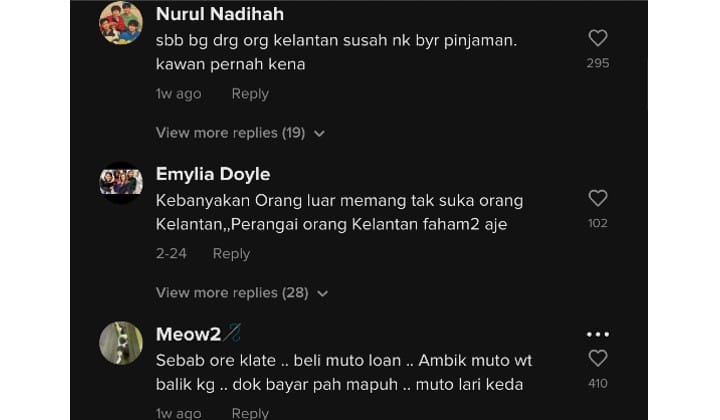

At the time of writing, the post received more than 340,000 views and received mixed comments from netizens.

According to a netizen, some Kelantan residents have poor loan payment records, causing harm to other innocent Kelantan people, and making it more difficult for people to apply for loans.

Some netizens claimed that many Kelantanese people apply for a loan from the bank, then drive their motorcycle home, never pay the loan, and disappear.

At the same time, netizens who had encountered the same problem also said that when the other party knew that he was not from Kelantan, the application was easily approved.

When I wanted to buy a motorcycle that day, the owner asked me if I was from Kelantan? I said no, and he accepted my loan application.

A netizen claiming his loan was easily approved just because he was not from Kelantan.

In this regard, many netizens believe that such a controversial and sensitive topic should be stopped immediately, otherwise it may cause social disharmony.

They said a person’s integrity should not be judged by which state he is from.

Netizens also feel strongly that there is no need to belittle the people of Kelantan since these are purely personal characters of individuals.

Kau kecam gomen kat medsos ni, kau otomatik jadi

— ramastu (@ramastu69) January 24, 2023

Walaun

Orang Kelantan

Lebai

Sekolah tak tinggi

Pentaksub

Rasis

So takyah la kecam. Kau puji je. Otomatik kau jadi

Bijak

Profesional

Berpendidikan

Harmoni

Majmuk

K bye …….

Serving The Lower-Income Group

One possible reason why Kelantanese people may prefer buying on credit is that such companies have a strong presence in the state, with several branches and outlets located throughout the region.

This makes it convenient for Kelantanese people to access consumer credit services and products.

Another possible reason why consumer credit may be popular in Kelantan is its accessibility to people with lower incomes.

Companies offering consumer credit usually offer a range of financing options with flexible repayment plans, which may be attractive to people who cannot obtain loans from traditional banks or financial institutions.

Additionally, they may offer competitive interest rates and fees, which can be appealing to Kelantanese people who are looking for affordable financing options.

While the interest rates may not always be the lowest in the market, they are generally competitive with those of other non-bank financial institutions in Malaysia.

so kalau pinjam 2000 kena bayar balik 2244 selama setahun. Tak ubah mcm Aeon credit 😂😂😂 https://t.co/tlSSuWaULw pic.twitter.com/AdtVh8VwrL

— Billie FX (@Fhxx96) April 3, 2022

It is important to note that these are just some possible reasons why Kelantanese people may prefer consumer credit.

Other factors, such as marketing efforts, word-of-mouth recommendations, and personal experiences, may also contribute to consumer credit’s popularity in Kelantan.

It’s worth noting that borrowing money always comes with a cost, whether it’s from a bank or a non-bank financial institution.

Before applying for any financing product, it’s important to read the terms and conditions carefully, including the interest rate, fees, and other charges.

Ensure that you understand the cost of borrowing and can afford to repay the loan on time.

Share your thoughts on TRP’s Facebook, Twitter and Instagram.