Terengganu Motorbike Shop Goes Full Throttle On Defaulters, Lists Out Full Name And Plate Numbers On Facebook

Some of the defaulters have not paid their monthly instalments for up to three years.

Subscribe to our new Telegram channel for the latest updates and stories.

Billions of people worldwide use social media to share information and make connections.

On a personal level, social media allows you to communicate with friends and family, learn new things, develop your interests, and be entertained.

Nowadays, it could also mean the world knows if you are late in paying your debt.

A motorcycle shop in Seberang Takir, Terengganu, has come down hard on defaulters by posting an eye-popping list of borrowers and vehicle plate numbers.

It listed out more than 160 names of ‘debtors’ listed along with their model and amount of arrears.

Among the motorcycle models popular among the ‘debtors’ are the Yamaha Y15ZR, the NVX, 135LC and Honda Beat.

The motorcycle shop made no effort to hide its disappointment.

There are some people who do not know how to thank us, when they have been given a good opportunity.

Motor Mok Mung on dealing with its chronic loan defaulters.

Importance Of Responsible Borrowing

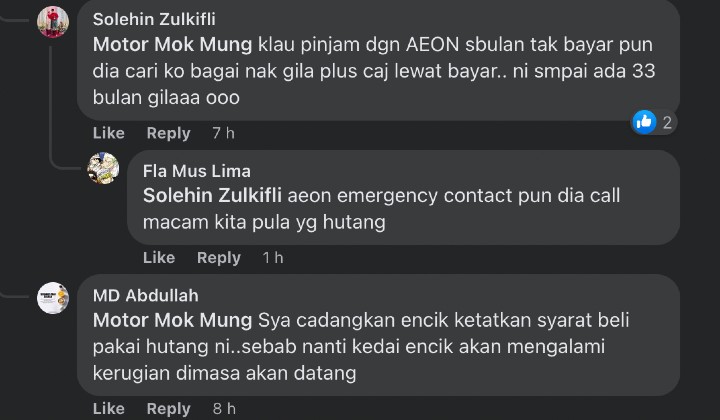

Netizens sympathized with the motorcycle shop after seeing the Facebook post.

They feel the motorcycle shop deserves better as they had given out loans to help their customers.

At the same time, netizens are indignant at the debtor and regard them as ungrateful for ‘disappearing’ without paying the loan.

Netizens also noted that the motorcycle shop had been very patient compared to typical financial institutions.

They demanded that the debtors clear the arrears as the shop had helped them get the desired motorbike.

Some added that in Islam, debt is an obligation that needs to be fulfilled.

Why Do People Borrow From The Shop And Not Banks?

Not everyone who works can produce a payslip or a bank statement to borrow from banks or third-party financial institutions.

Some applicants are also unable to borrow because they have bad credit.

These people have to rely on dealer or ‘shop’ financing, a type of loan underwritten by a retailer for its customers.

Sediakan IC & LESEN MOTOR jer pic.twitter.com/ZWR8yFJl14

— motormokmung (@motormokmung) March 4, 2021

The aim is to make borrowing quick and more accessible, but borrowers may not always get the best terms and conditions.

Some buyers even say dealerships are pushing them to borrow because they make more money that way.

Ikut nasib gak la. Haritu sembang² dulu tak cakap pun nak beli cash. Pastu saja cakap urgent kalau boleh nak dapat motor harini. Sales tu terus bagitau ada ready stok. Pergi kat meja nak isi details baru bagitau nak beli cash 😂 dari senyum terus hilang senyum member tu 😂😂🤣 https://t.co/ZzLk3PK55k

— Qusam Zainal (@queznl) June 21, 2022

Share your thoughts on TRP’s Facebook, Twitter and Instagram.