CCRIS BNM: How To Review eCCRIS Reports Online Without Going To The Bank

A financial institution or banks typically do background checks on the applicant.

Subscribe to our Telegram channel for the latest stories and updates.

Anyone who wants to make a bank loan must obtain a financial report such as CCRIS, which stands for Central Credit Reference Information System.

CCRIS is owned and operated by Bank Negara Malaysia (BNM) to facilitate credit risk management among banks.

CCRIS processes data from participating financial institutions and turns them into credit reports.

All your loan records with the bank will come out in a straightforward statement, and the bank will use this CCRIS report to assess your loan eligibility.

Many people misunderstand CCRIS as a system that blacklists borrowers.

CCRIS only issues reports that the respective financial institutions update to analyze the following:

- Payment records

- Total loan amount

- Application record

Thanks to partner that allow us to check CTOS report. CTOS & CCRIS report is very important sebab boleh tahu commitment pasangan & mudah nak susun atur kewangan lepas kahwin nnti😉 Apa apa pon ask permission partner dulu. Good Luck semua ❤️

— Ain Potter (@Nainrahman) October 16, 2021

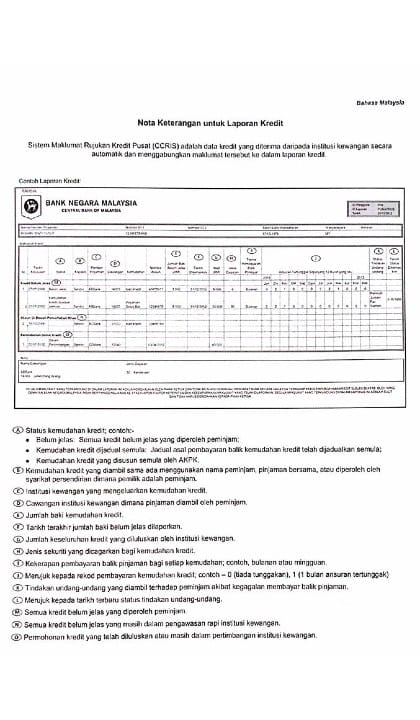

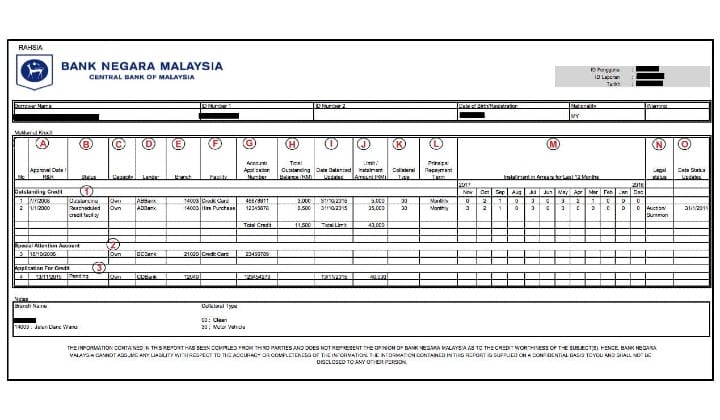

Understanding The CCRIS Report

Here are the three main components that can be found through the CCRIS review

- Existing loan records – information, type, amount, credit provider, legal action and so on

- Accounts under special supervision – unpaid credits placed under the special supervision of a financial institution

- Application for credit – the status of the application for the loan made

Through the CCRIS report, you can see your payment records to the bank.

If you often pay on time, before the deadline, your record will be written with the number ‘0’ every month.

The number ‘0’ indicates that you have never paid late to the bank.

However, if you pay late, your record will be written with the number ‘1’ if one month late, ‘2’ if two months late and so on.

Check Your CCRIS Online (eCCRIS)

The service is free to use but requires initial in-person registration at any branch of BNM Malaysia.

Once registered, you can check your CCRIS report at leisure through the dedicated online eCCRIS portal.

With this facility, you no longer need to go to the counter and can only get your credit report online.

To register for eCCRIS, please follow these steps:

- Complete the form at the BNM Telelink eCCRIS link: bnm.my/LINK

- Upload the following documents

- Copy of MyKad (front and back)

- Current phone bill

- Two other supporting documents, i.e. driver’s license, utility bill, bank account statement, credit card statement and so on

- A 6-digit temporary PIN will be sent to the registered mobile number

- Visit eCCRIS and click First Time Login.

- Enter the MyKad number and 6-digit temporary PIN. Follow the on-screen instructions to complete registration.

- To check the statement, please visit the CCRIS website.

Please refer to the infographic below for more information:

Is CCRIS The Same As CTOS?

CTOS is a credit reporting agencies registered by the Ministry of Finance under the Credit Reporting Agencies Act 2010.

CTOS stands for Credit Tip-Off Service, and the company is categorised as Credit Agency.

It provides an information system widely used by most of the country’s financial institutions, commercial companies and businesses, legal firms and other institutions.

CTOS Score is a 3-digit number that represents your creditworthiness.

It evaluates individual credit history and capability to repay financial obligations.

The higher the score, the higher your chances of securing a loan.

Share your thoughts via TRP’s Facebook, Twitter, and Instagram.