“Your Family Will Have To Pay Your House Debt If You Die” Netizens Warned To Be Aware Of Their House Insurance Policies

Even if they get the insurance, they would still have to pay the remainder of the loan.

Subscribe to our Telegram channel for the latest stories and updates.

Buying a house can be a daunting task for many, with the loan for these assets spanning up to multiple decades and also the costs that you have to put up with within the space of time.

One user shared on a Facebook group about the Mortgage Reducing Term Takaful (MRTT) or Mortgage Reducing Term Assurance (MRTA), which are insurance products that buyers have to take when they purchase a house.

It was originally written by user Azri Johan before it was reshared again recently.

The post starts off with the user saying that buyers should be aware of the important bits of information regarding their purchase including loan tenure and MRTT/MRTA coverage.

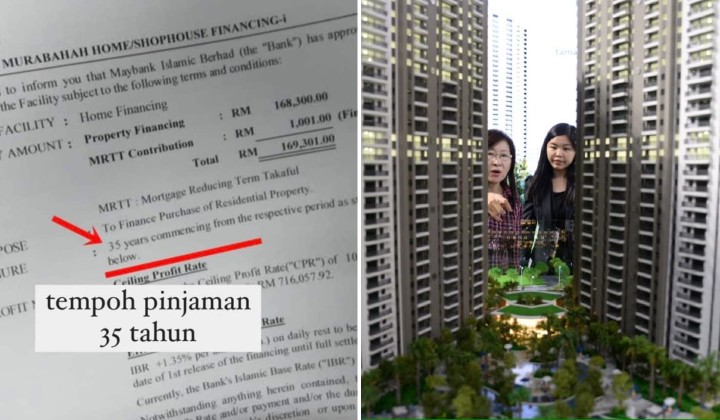

Many think that when buying a house, the house is 100% theirs. I was like that before. But in fact, if we buy a house on a loan with a bank, we have to check back our loan agreement. How long is a loan with a bank? How long is MRTT/MRTA coverage? This thing is the period the bank covers the loan in case of the death of a borrower during the period of still owing the bank. Please avoid being like the case below. Loan with a bank for 35 years, but MRTT coverage is up to 10 years 😱How long is a loan with a bank?

The post went on to describe what happens if a person dies within that 10-year period.

That is, if we die within the 10-year coverage period, the heirs can make a claim at the bank. But even this MRTT claim can’t cover the remaining loan, the heirs have to top up and use their own money 😥 Worst case scenario, if you die in the 11th year to the 35th year, the balance of your loan must be settled by your family members.

If the person is married, the post mentioned, then the burden will then fall on their surviving spouse or family members.

It is sad to lose the head of the family, even sadder when you have to bear a debt of hundreds of thousands of ringgit.

What happens when you can’t settle the debt

In the event that the family members can’t manage to pay back the loan, the house would have to be auctioned.

As long as we do not settle the debt with the bank, the bank has the right to our house. After all, banks must not lose money, because they are not charities. Right?Moral of the story. How much the insurance covers the house we bought.

Subscribe to our Telegram channel for the latest stories and updates

Unkempt in both stories and appearance, Hakim loves tech but tech left him on read, previously he used to write about tall buildings and unoccupied spaces that he can't afford, and legend has it that he still can't afford it to this day