Bank Negara: Don’t Worry, Financial Aid Will Be Available Up To 2021

To extend relief measures more sustainably, BNM said a targeted approach to will be used.

Subscribe to our Telegram channel for the latest stories and updates.

Repayment assistance is available for borrowers who are affected by the pandemic throughout 2020 and into 2021, said Bank Negara.

According to a statement released by the central bank, depending on their circumstances, borrowers who are facing financial difficulties generally opted for reductions in monthly repayment instalments or an extension of the moratorium.

Borrowers who declined repayment assistance for now would still be able to apply for targeted assistance throughout 2020 and into 2021 if their financial circumstances change in the future.

Bank Negara Malaysia

Many have applied for assistance

The bank said that assistance continues to be offered to borrowers across a range of income groups, with special consideration given to households from the B40 category, micro businesses as well as borrowers affected by movement restrictions.

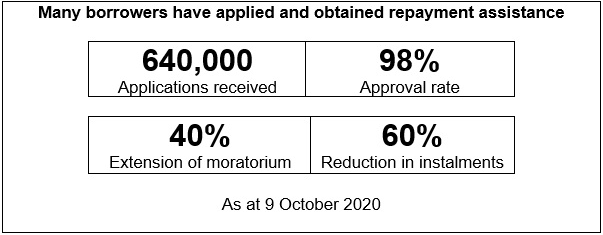

More than 640,000 applications for repayment assistance have been received, with an approval rate of around 98%. The types of packages offered by banks reflect the financial needs and circumstances of the borrowers.

Bank Negara Malaysia

READ MORE: BPN 2.0 – Who Can Get, How Much & When Will The Money Arrive?

Below are the stats:

40% were granted an extension of the moratorium which BNM said consists mainly of individuals who have been recently made unemployed, as well as businesses in sectors that may still be experiencing significant operating constraints caused by the pandemic.

The bank also noted that 60% received a reduction in instalments and borrowers who have requested a reduction in instalments include those in the B40 group.

These instalment reductions put individuals and SMEs (Small and Medium Enterprises) on a path to start paying down their loans, at levels which they are comfortable with.

Bank Negara Malaysia

Among individuals who requested repayment assistance to date, BNM said, about 50% have a monthly income of RM5,000 or less while 28% are those with a monthly income between RM5,000 to RM10,000.

Borrowers in other segments who need assistance are also being supported, including those who earn variable incomes, and those employed in sectors that have been hardest hit such as the tourism sector.

Bank Negara Malaysia

Banking on a targeted approach

To extend relief measures more sustainably, BNM said a targeted approach will be used.

It noted that many borrowers can and have started to resume repayments but if their financial circumstances change down the road, the bank assured, targeted repayment assistance would still be available.

Borrowers who require assistance at this time have the opportunity to customise their repayment plans based on what they can afford. If their circumstances are further challenged in the future, they would have more recent repayment records to facilitate further assistance by banks.

Bank Negara Malaysia

By doing this, BNM said, the banking system’s financial resources can be prioritised to help those most affected by COVID-19.

As more borrowers who can afford to repay do so, more assistance can be made available to borrowers that need it.

Bank Negara Malaysia

.jpg)

CMCO or EMCO, it’s still business as usual

BNM urges affected borrowers to come forward to apply for repayment assistance with their banks through the various channels available.

It said that banks are required to respond to applications for targeted repayment assistance within 5 days for individual borrowers and within 14 days for SME borrowers.

Banks will still continue to operate even in Conditional Movement Control Order (CMCO) or Enhanced Movement Control Order (EMCO) areas and those unable to go to the bank due to movement restrictions can contact their banks instead via website, phone or email.

Those who haven’t received a response from their banks can contact BNMTELELINK.

Share your thoughts with us on TRP’s Facebook, Twitter, and Instagram.

Unkempt in both stories and appearance, Hakim loves tech but tech left him on read, previously he used to write about tall buildings and unoccupied spaces that he can't afford, and legend has it that he still can't afford it to this day