I Tried PayLater To Manage My Budget For 2 Weeks And Here’s What I Think [Review]

It does make budgeting and tracking my spending easier but it’s only for purchases within the app.

Subscribe to our Telegram channel for the latest stories and updates.

Since young, we’ve been told to always save our money for a rainy day. There are a few ways to do this. We can save leftover cash or coins in a jar at home, unsubscribe from services we don’t really need or simply not shop at all.

However, not all of those options are feasible in the long run. A tried and tested way to really save up money is to set a budget and stick to it so we don’t spend more than we can handle.

There are many budgeting tools out there in the market and that includes a new feature in the Grab app called PayLater.

PayLater is essentially a payment option in the app which allows Grab users to purchase items right away but pay it later or in four monthly instalments.

I get to try it!

At a glance, using it is pretty straightforward. After activating PayLater in the app under ‘Payments’, Grab automatically sets a comfortable and appropriate limit we’re allowed to spend based on our spending history in the app.

Seeing everything I buy in a concise list together with the overall total shown helps to keep track of my spending better. I find that I’m less likely to shop impulsively when I see the total racking up.

To find out which shops accept PayLater, I went through the list of shops on the PayLater page in the app.

I was surprised to find that there are a lot of shops accepting PayLater such as Zalora, Lancome, TT Racing and even gadget shops such as Gamer’s Hideout.

Of course, we can pay for any Grab services such as GrabFood and GrabMart using PayLater too.

I’ve bought items such as groceries from Jaya Grocer, dinner and paid for my Grab rides using PayLater with no issues at all.

During my first try, I almost paid with a debit card but luckily it was easy to switch between using the debit or credit card and PayLater.

All I had to do was to select the ‘PayLater’ option (purple logo) before clicking the ‘Check Out’ button.

Paying in instalments

The option to pay in instalments is great when we need to make a big purchase but don’t have the means that month to pay things upfront.

Maybe your laptop or monitor for work stops functioning and you urgently need to get a new one soon.

I tried the option to pay in four instalments when I purchased a monitor and hard disk for work. After going through several IT shops in the Grab app, I found the items I needed in All IT Hypermarket.

Clicking on the shop in the Grab app takes me to the All IT Hypermarket website. After adding the items to the cart, it took me a while to figure out how to pay in instalments using PayLater.

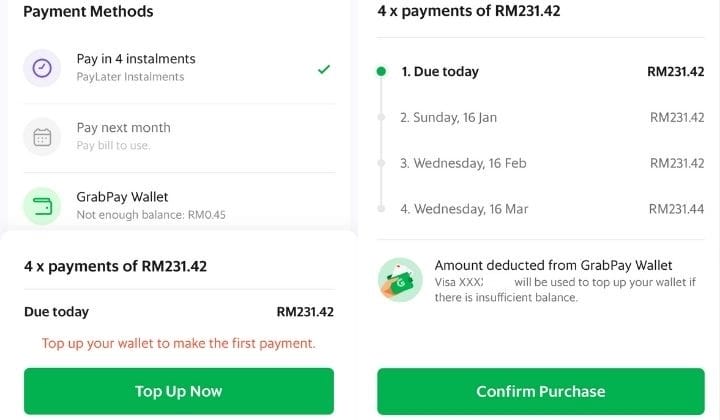

It turns out the option to pay in instalments pops up after I hit the ‘Check Out’ button.

Once you get to the ‘Payment Methods’ page, remember to select ‘PayLater’ which is listed under the ‘eWallet’ section.

Selecting ‘PayLater’ then takes me back to the PayLater page in the Grab app. From here, we can add more available discounts before confirming the purchase.

Do take note that the first instalment will be paid via the GrabPay Wallet. There’ll be a prompt to load the GrabPay Wallet in order to pay for this.

How do I pay the outstanding bill?

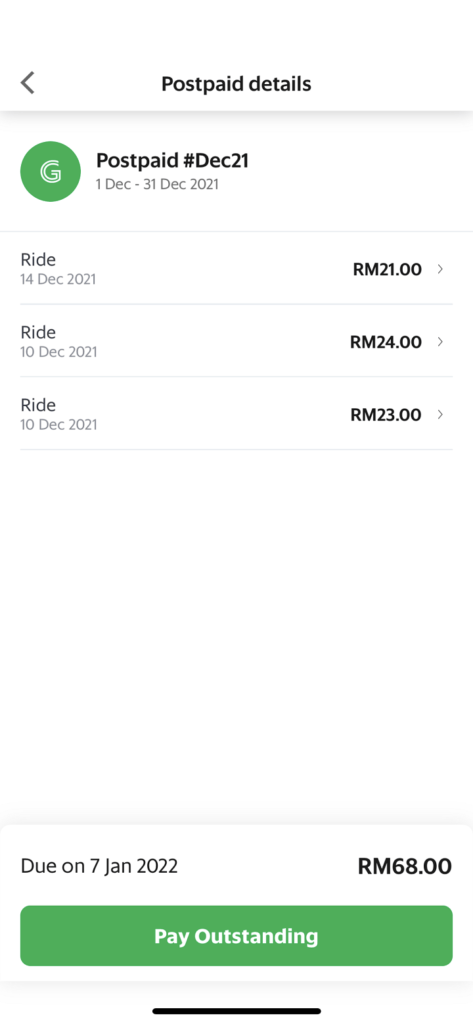

To pay off the outstanding bill, I just need to tap on the green ‘Pay Outstanding’ button at the bottom and the amount will be deducted from the card linked for auto-deduction.

What’s great about PayLater is that I don’t have to worry about paying any interest at all and no annual fee is required.

In other words, I’m paying the exact amount of money I intend to spend with no extra or hidden charges and that really helps when it comes to budgeting.

However, we won’t be able to use PayLater if the outstanding bill is overdue. According to Grab, we need to pay an administrative fee of RM10 to reactivate the suspended PayLater account.

To be safe, Grab recommends linking a credit or debit card on your PayLater account for auto deduction or ensuring there’s a sufficient GrabPay balance before the 7th of every month.

Can we save more money?

Ultimately, the reason why we set a budget to follow is so that we can track our expenses and earnestly save some money. By using PayLater and shopping in the Grab app, I get to look for all the discounts available in one place.

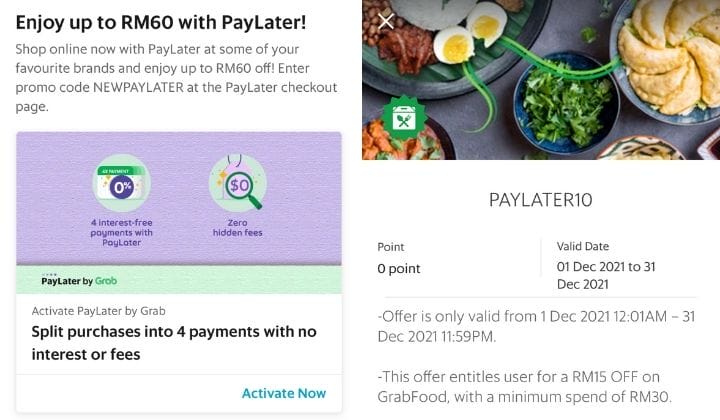

Before adding items to the cart, look out for the discounts and offers available in the shop. If you’re lucky, you can stack discounts to shave off a larger total from the bill.

Sometimes these discounts are offered by the shops themselves or they can be redeemed by using the GrabRewards points you’ve collected.

I didn’t have enough points to redeem any extra discounts so I had to make do with the discount codes offered for first-time users and the ones given by the shops.

With the discounts codes I have, I managed to shave RM15 off my when I bought dinner and saved RM60 when I purchased the gadgets.

For some items, I get to save a little more and get a discount when I buy items such as groceries in bulk.

Limitations I found

PayLater is only useful as a budgeting tool for those who use the Grab app a lot. This is because the other expenses incurred outside of Grab will not be reflected in the app.

While it’s great that I can see when the due date to pay the outstanding bill is, I can’t choose which ones I can pay up first. As far as I can see, I only have the option to pay the outstanding bills in a lump sum which is not something all of us can do.

So before you happily purchase the items, it’s advisable to calculate how much you can pay off the next month and that’s part and parcel of spending responsibly.

It’ll be extra helpful if we get an alert when we go over budget before purchasing the items too.

I also found out that I can only earn GrabRewards points if I make purchases using PayLater Postpaid. No points are earned if I paid via instalments.

Pros and cons recap

Pros:

- The expenditure is shown in a concise list so it’s easy to track your spending.

- The due date to pay the outstanding bill is shown in the list.

- Can buy big purchases in instalments so you won’t go completely broke for the month.

- Can check out discounts available to shave off your total bills all in one app.

Cons:

- Only useful for frequent Grab users because the expenses outside of Grab and PayLater won’t be included in the app.

- The outstanding bill has to be paid in a lump sum unless it’s paid in instalments.

- No alerts if you’re going to exceed the set budget.

- Can only collect GrabRewards points if I pay using PayLater Postpaid.

Share your thoughts with us via TRP’s Facebook, Twitter, and Instagram.