Everything You Need To Know About Malaysian Income Tax

“What is income tax? Do I need to pay income tax? How do I pay income tax?” We answer all your questions.

Subscribe to our Telegram channel for the latest stories and updates.

As the saying goes, nothing in this world is certain except death and taxes, and it seems that Malaysians have been busy educating themselves and their fellow taxpayers on the ins and outs of the country’s income tax system.

MASIH RAMAI YANG TAK TAHU BILA KENA DECLARE TAX KAN?

— FAA (@f4teyhaa) March 17, 2021

1. GAJI > RM34,000 selepas potongan KWSP

Boleh refer dekat EA form korang sebab situ gaji dia dah lump sump kan setahun berapa so korang dah boleh tahu lebih dari RM34,000 ke tidak pic.twitter.com/DQ7xSlIAXi

But what the heck is this income tax thing anyways? And do I really, really need to pay up?

Well… the short answer would be yes if you’d like to avoid paying a hefty fine or not spend time in jail.

Under Section 114 of Malaysia’s Income Tax Act 1967, evading taxes can cost you a fine of between RM1,000 and RM20,000 or up to three years imprisonment, or both.

Not paying your taxes can also bar you from travelling out of the country. Here’s a mime explaining what a “stoppage order” is for tax evaders.

Think of income tax (or any other tax) as a “fee” that you need to pay the government for the money and assets that you have – where the more you have, the more you are taxed.

The government then uses this money to provide for essential and non-essential services that make the country function as it should.

READ MORE: Why you should pay your income tax (even without billions in donations)

Since 2015, anyone who makes an annual employment income of RM34,000 after deducting one’s EPF contributions needs to file and pay their taxes.

Both Malaysian citizens and foreigners with residential or non-resident status are required to pay income tax.

The Malaysian government considered everyone in the country, regardless of nationality, as a tax resident if they fulfil certain requirements. For more details on foreign taxpayers in Malaysia, check out this explainer by CompareHero, HERE.

So how much do I need to pay as a citizen?

That would depend on your total annual income for that particular tax year derived from your chargeable or taxable income, such as;

- The salary earned from employment or pensions

- Revenue earned from businesses or if you’re a landlord collecting rent

- Dividends and interests earned from investments and annuities

- Royalties and payments collected from copyrights or patents

- Perquisites including claims, loans, credit cards and benefits offered by employers that can be converted to cash.

Because Malaysia employs a self-assessment tax system, you’d need to figure out your taxable income as well as responsible to submit or declare your income tax return to the government on your own.

Additionally, some portions of your taxable income are also eligible for tax exemptions, deductions and relief, essentially reducing the overall tax that you need to pay and thus making it important to keep all of your spending receipts handy when and if you need to file your taxes.

Examples of tax exemptions;

- Spending made on vacations

- Medical and dental benefits provided by employers

- Compensation for loss of employment

- Purchase of certain consumer products

Examples of tax deductions;

- Donations and gifts made to charity and approved organizations.

- Monthly Tax Deduction (MTD) or the tax you paid through your employer.

Examples of tax relief;

- Reliefs gave based on how many dependants are under your care.

- If you own insurance and other policies

- If you are paying student loans

- Purchases of certain consumer products like books, devices and equipment.

- Payment of monthly bills.

READ MORE: Things To Buy Before 2020 Ends For Your Income Tax Relief Next Year

Malaysians are also eligible to receive tax rebates or reductions made to the amount of tax you pay after your annual tax calculation.

This is different from tax reliefs and deductions that are made to your taxable income.

Individuals with a taxable income of less than RM35,000 are eligible for a rebate of RM400 each, while couples can claim an additional rebate of RM400 each if either spouse has no income.

Tax rebates are also given to Muslims that pay Zakat based on how much they paid during the tax year.

Rebates will be given automatically to those who file their income tax return with the Malaysian Inland Revenue Board (LHDN).

Besides rebates, those who made excess tax payments through their MTDs will also be reimbursed directly once their taxes are filed, thus making it important for everyone, really, to file their income tax returns.

For more information, check out this definitive guide to Malaysia’s income tax process made by imoney, HERE.

So how do I file and pay my income tax?

Income tax payments can be made online on the LHDN site via online banking and credit cards. Additionally, payments can also be made through over the counter services at participating banks or with POS Malaysia.

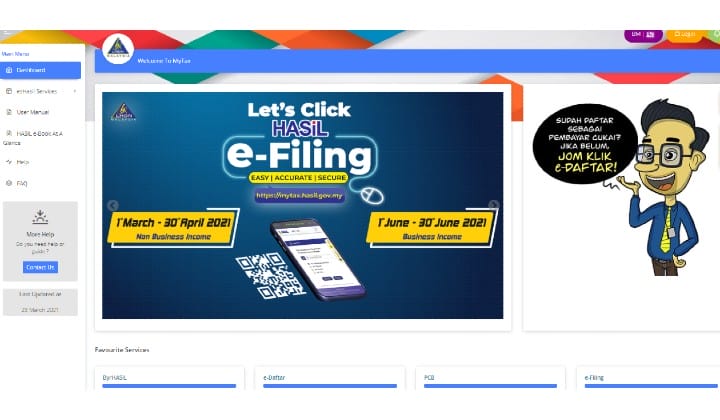

Malaysians can register, file and access their tax information through the official MyTax website or mobile application.

It’s my first time, what do I need to do?

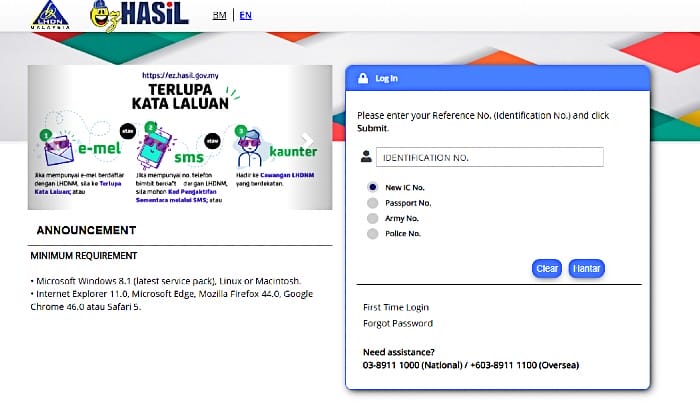

For first-timers, you would first need to register for an account with LHDN.

Have a snapshot of your IC or MyKad ready and visit the MyTax portal, HERE, to proceed to the “e-Daftar” menu and fill up the online registration form.

Once you’ve submitted your registration form, you would then need to acquire a 16-digit PIN number from LHDN to access open and access your account for the first time.

To do this, you would need to head on over to a separate login site, HERE, click on “First Time Login” and make an online application for the PIN number.

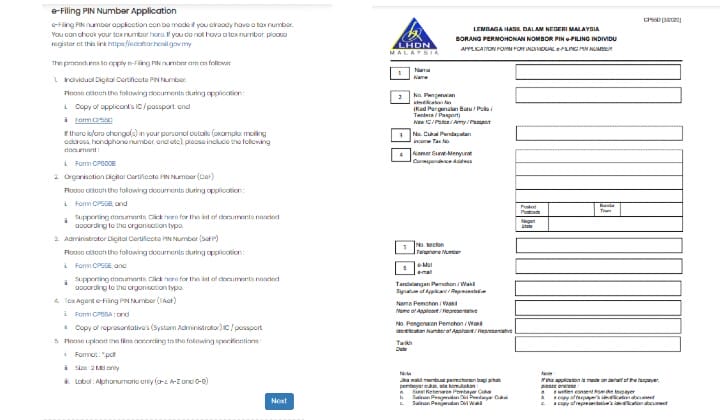

To request a PIN, users would need to head on over to a separate request page, HERE, and click on the “Form CP55D” to download a copy of the form.

You would then need to upload the filled-in form together with your IC snapshots to complete the PIN number request. LHDN would then email you the PIN number that you can use to log in, HERE.

Once you have access to your account you can then begin e-filing your tax returns through the menus available on the site.

For a more comprehensive tutorial on how to register and file your income tax return for the first time, check out this easy-to-understand guide made by Mr Money TV on YouTube.

Or check out the user manual on how to use the MyTax platform, HERE.

Share your thoughts with us on TRP’s Facebook, Twitter, and Instagram.

Typing out trending topics and walking the fine line between deep and dumb.