All The Social Safety Nets We Could Find For Malaysians In Times Of Trouble

Subscribe to our new Telegram channel for the latest updates on Covid-19 and other issues.

Social safety nets, or social protection, is essentially a set of policies and programmes designed to ensure a basic standard of living in a nation. So, it’s often considered a human right.

Academics have continually emphasised its importance as a contributor to social and economic sustainability and development amongst the public.

Social protection works to reduce poverty and helps protect people from shocks such as health issues and loss of income. A comprehensive social protection system that covers the whole population is vital as poor coverage is often linked with national poverty issues.

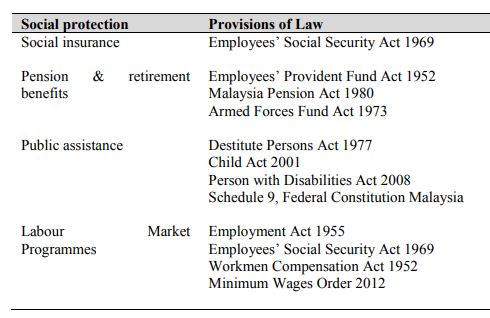

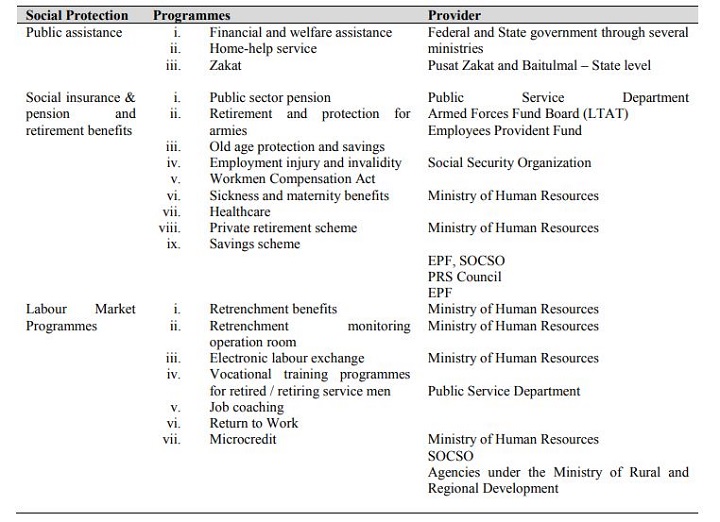

Social protection in Malaysia

There’s three broad categories of social protection in Malaysia, namely:

- social insurance

- public assistance

- labour market incentives

However, social protection can also be easily identified as protection that promotes basic standard of living and protection that protects against shocks.

Basic standard of living

Public education

Primary and secondary education is free for Malaysians up to the completion of Sijil Pelajaran Malaysia (SPM).

Pre-university education in the form of Sijil Tinggi Pelajaran Malaysia (STPM) is also free while tertiary education at national universities are heavily subsidised.

Income supplementation

Bantuan Sara Hidup (BSH) is a cash transfer for the B40 group administered by the Inland Revenue Board (LHDN).

Financial assistance is given throughout the year to households earning below RM4,000 a month and individuals earning below RM2,000 a month.

Skim Bantuan Kebajikan is administered by the Malaysian Welfare Department for households and individuals that are poor or vulnerable.

The target group includes hard core poor and poor, old citizens, disabled, single mothers, orphans and victims of natural disasters who are eligible for cash transfers as well as other assistance.

Additional financial and welfare assistance is also given through state governments.

Pension & retirement benefits

The Employee Provident Fund (EPF) is a compulsory savings scheme especially for old age and retirement. However, a portion of the savings is allowed for specific purposes such as education, medical expenses and down-payment for first home purchases.

Enforced under the Employees’ Provident Fund Act 1952, all Malaysian private sector employees are covered by the scheme while non-Malaysians and self-employed Malaysians can join voluntarily.

Employer’s share to the EPF is at 12% or 13% (depending on employee wages) while employees can opt to contribute a minimum of 7% or 11%. Employees have the option to change the rate of contribution depending on the government’s policy in reaction to economic downturns.

Public sector employees and their dependents receive a pension through the Malaysia Pension Act 1980.

Protection against shocks

(Credit: International Journal for Studies on Children, Women, Elderly And Disabled, Vol. 5, (Oct.) 2018)

Healthcare

The point of pride for most Malaysians is the affordable public healthcare with basic treatment fees at only RM1.

The public healthcare system is heavily subsidised and available to all Malaysians.

While there is no national health insurance system, the MySalam scheme was introduced last year for individuals aged between 18 to 65 years old in the B40 and M40 groups (with yearly income below RM100,000).

(Credit: The Star)

Through this scheme, cash payouts are given upon diagnosis of certain critical illnesses and hospitalisation allowance in government hospitals. However, the registration is now closed.

A supplementary PeKa B40 scheme for individuals in the B40 group was introduced in April 2019 to sustain the healthcare needs of low-income groups by focusing on non-communicable diseases such as cancer and mental health problems.

This programme is available only to BSH recipients and their registered spouses aged 40 years old and above.

Social insurance

Under the Employees’ Social Security Act 1969 and Employment Insurance System Act 2017, employees earning below RM4,000 a month must make salary-deducted contributions to the Social Security Organization (SOCSO). It is optional for those earning above RM4,000 and the self-employed.

This insurance scheme covers injury or disability from workplace accidents as well as providing pensions for invalidity or death not related to employment.

Employees SOCSO are matched by employers and the rate differs according to wages (CHECK HERE).

A Self-Employment Social Security Scheme (SEEIS) was introduced in 2017 for all taxi, e-hailing, and bus drivers who work full-time or part-time. The scope of SEEIS was expanded in Budget 2020 to other informal sectors such as agriculture, fisheries, own business and self-employed arts practitioners.

The Employment Insurance System (EIS) also offers two kinds of benefits, namely monetary benefits and job search assistance.

Those who are unemployed are eligible to receive job search allowance, reduced income allowance and training allowance.

The EIS is available to Malaysian citizens and permanent residents aged between 18 to 60 years old who are working in the private sector.

(Credit: International Journal for Studies on Children, Women, Elderly And Disabled, Vol. 5, (Oct.) 2018)

Share your thoughts with us on TRP’s Facebook, Twitter, and Instagram.

She puts the pun in Punjabi. With a background in healthcare, lifestyle writing and memes, this lady's articles walk a fine line between pun-dai and pun-ishing.